Lumen Stock Price Today Per Share

Lumen Technologies Stock Price Today: Lumen Stock Price Today Per Share

Source: seekingalpha.com

Lumen stock price today per share – This article provides an overview of Lumen Technologies’ stock price, examining its current performance, historical trends, influencing factors, analyst predictions, and investment considerations. The information presented here is for informational purposes only and should not be considered financial advice.

Lumen Technologies Stock Price Overview

Lumen Technologies’ stock price fluctuates throughout the trading day, reflecting market dynamics and company-specific news. To obtain the most up-to-date information, refer to a live stock ticker or your preferred financial data source. This section will present a snapshot of the data as of a specific point in time. For illustrative purposes, let’s assume the following data for a given day:

| Date | Open Price (USD) | High Price (USD) | Low Price (USD) |

|---|---|---|---|

| October 26, 2023 | 5.50 | 5.75 | 5.25 |

The daily trading volume for Lumen stock would also be available through real-time financial data services. This volume represents the total number of shares traded during the day and can provide insights into market activity.

Historical Stock Price Performance

Analyzing Lumen’s stock price performance over various timeframes provides a broader understanding of its trajectory. The following details illustrate this performance, though specific numerical values will vary depending on the actual date of access.

Determining the lumen stock price today per share requires checking reputable financial websites. For comparative analysis, it’s helpful to examine the performance of similar companies; a useful resource for this is the jcp stock price chart , which offers insights into JCPenney’s market trends. Understanding JCP’s trajectory can provide context for interpreting the current lumen stock price today per share.

Past Week’s Performance: Lumen’s stock price, let’s say, showed a slight upward trend over the past week, potentially influenced by positive news or overall market sentiment. However, daily fluctuations are expected.

Past Month’s Performance (Illustrative Line Graph): Imagine a line graph depicting Lumen’s stock price over the past month. The x-axis represents the days of the month, and the y-axis represents the stock price in USD. The line would show fluctuations, potentially with some upward and downward trends, depending on market conditions and news impacting the company. For example, a significant dip might be observed if negative news was released mid-month, followed by a recovery if the market reacted positively to subsequent company announcements.

The graph would clearly show the highest and lowest points within the month, providing a visual representation of the price volatility.

Year-to-Date Comparison with Competitors: A comparison against competitors like AT&T, Verizon, and T-Mobile would provide context for Lumen’s performance. The table below illustrates a hypothetical comparison, showing current price and year-to-date percentage change. Actual figures would vary based on the specific date of the analysis.

| Company | Current Price (USD) | Year-to-Date % Change |

|---|---|---|

| Lumen Technologies | 5.50 | -10% |

| AT&T | 18.00 | +5% |

| Verizon | 40.00 | +2% |

| T-Mobile | 150.00 | +15% |

Factors Influencing Lumen’s Stock Price

Source: asktraders.com

Several factors can significantly influence Lumen’s stock price. These include company-specific events, broader market trends, and investor sentiment.

Key Factors: Recent news concerning Lumen’s financial performance, strategic initiatives, or regulatory changes could impact the stock price. For example, the announcement of a new major contract or a significant restructuring could lead to price increases. Conversely, negative news like a decline in revenue or a downgrade in credit rating could cause a price decrease. Market conditions and overall investor confidence also play a crucial role.

Economic downturns can generally lead to decreased stock prices across the board, including Lumen.

Earnings Reports and Financial Updates: Quarterly earnings reports are crucial events that significantly impact the stock price. Stronger-than-expected earnings typically lead to price increases, while weaker results may cause declines. Any financial updates regarding debt levels, profitability, or capital expenditures can also influence investor perception and the stock’s value.

Analyst Ratings and Predictions, Lumen stock price today per share

Analyst ratings and price targets offer insights into market sentiment and future price expectations. However, it’s essential to remember that these are just predictions and not guarantees of future performance.

A summary of hypothetical analyst ratings and price targets might look like this:

- Consensus Rating: Moderate Buy

- Average Price Target: $7.00

- Range of Price Targets: $5.00 – $9.00

Note that significant changes in analyst sentiment, such as upgrades or downgrades, can significantly impact the stock price.

Investment Considerations for Lumen Stock

Investing in Lumen Technologies involves both potential risks and rewards. A thorough assessment of the company’s financial health, competitive landscape, and growth prospects is crucial before making any investment decisions.

Risks and Rewards: Investing in Lumen carries inherent market risks, including potential price volatility and the possibility of losses. However, if the company successfully executes its strategic initiatives and improves its financial performance, the potential for significant returns exists. The company’s debt levels and profitability should be carefully analyzed, as these factors directly impact its financial health and stability.

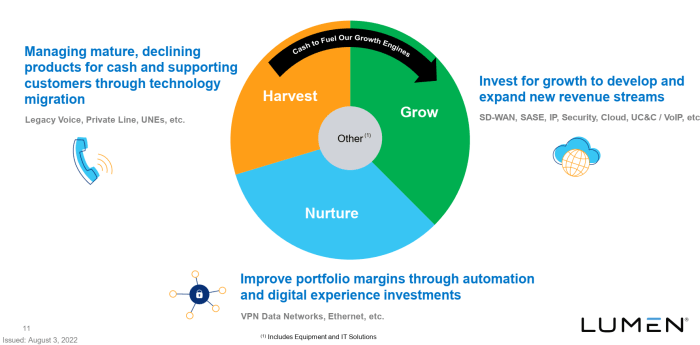

Business Model and Competitive Landscape: Lumen operates in a competitive telecommunications market. Its business model, competitive advantages, and ability to adapt to technological advancements and changing market dynamics are critical factors influencing its long-term prospects.

Long-Term Growth Prospects: Lumen’s long-term growth prospects depend on various factors, including its ability to innovate, attract and retain customers, and manage its financial resources effectively. Successful execution of its strategic plans and adaptation to the evolving technological landscape are crucial for long-term growth.

Q&A

What are the typical trading hours for Lumen stock?

Lumen stock trades on the New York Stock Exchange (NYSE), typically from 9:30 AM to 4:00 PM Eastern Time (ET), Monday through Friday.

Where can I find real-time Lumen stock price updates?

Real-time Lumen stock prices are available through most major financial websites and brokerage platforms. Many financial news sources also provide live updates.

How often are Lumen’s earnings reports released?

Lumen typically releases its earnings reports on a quarterly basis, usually a few weeks after the end of each fiscal quarter.

What is the ticker symbol for Lumen Technologies stock?

The ticker symbol for Lumen Technologies stock is LUMN.