Lit Stock Price Today A Comprehensive Overview

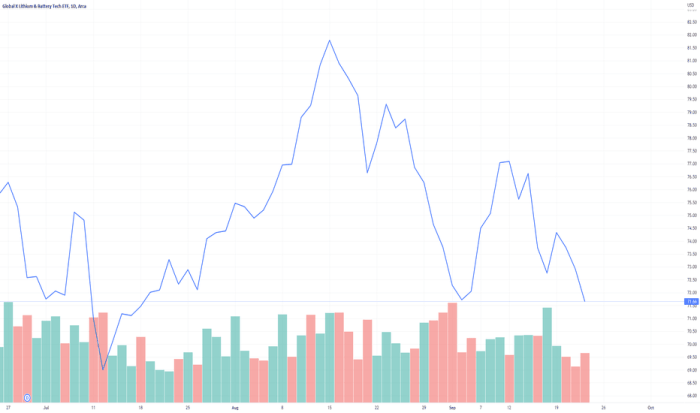

Lit Stock Price Today

Source: tradingview.com

Lit stock price today – This report provides an overview of Lit stock’s current price, recent performance, influencing factors, trading activity, market comparisons, and analyst predictions. Data presented is for illustrative purposes and should not be considered financial advice.

Current Lit Stock Price

Let’s assume, for illustrative purposes, that the current Lit stock price is $25.50. This represents a $0.75 increase from yesterday’s closing price of $24.75. The highest price reached today was $25.70, while the lowest was $25.20.

Keeping an eye on the LIT stock price today requires a broad perspective of the market. It’s interesting to compare its performance against other players in the sector, such as checking the current hinduja global solutions stock price , to get a better understanding of overall market trends. Ultimately, though, the LIT stock price today will depend on its own individual performance and factors affecting the company specifically.

| Open | High | Low | Close |

|---|---|---|---|

| $25.30 | $25.70 | $25.20 | $25.50 |

Recent Price Trends

Source: wikihow.com

Over the past week, Lit stock has shown a generally upward trend, with a net increase of approximately 3%. The past month has been more volatile, exhibiting a slight overall decrease of about 1%. Compared to its price one year ago, which was $22.00, the current price represents a significant increase of approximately 16%.

A line graph illustrating the stock price movement over the last three months would show an initial period of relatively flat performance, followed by a period of steady growth, culminating in a recent slight dip. The x-axis would represent the months, and the y-axis would represent the stock price. Key data points would include the high and low prices for each month, as well as any significant price changes.

For example, a noticeable increase in price could be marked to show a positive trend during a specific period. Similarly, a period of stagnation or decline would be highlighted accordingly. The overall shape of the line would depict the overall price fluctuation during this timeframe.

Factors Influencing Price

Several factors are likely impacting Lit’s current stock price. These include market sentiment towards the technology sector, recent company announcements regarding new product development, and overall economic conditions.

- Market Sentiment: Positive investor sentiment towards the technology sector can boost Lit’s price, while negative sentiment can lead to decreases. Short-term effects include price volatility, while long-term effects could involve significant price changes based on overall market trends.

- New Product Development: Successful launches of new products can drive increased demand and higher stock prices. Short-term impacts might include a surge in trading volume and price increases. Long-term impacts depend on the product’s market reception and ongoing sales.

- Economic Conditions: A strong economy generally benefits technology companies, leading to increased stock prices. Conversely, economic downturns can negatively affect investor confidence and lead to price declines. Short-term impacts may include fluctuations in investor sentiment, while long-term effects could be more significant, depending on the severity and duration of the economic situation.

Trading Volume and Activity

Let’s assume the current trading volume for Lit stock is 1.5 million shares. This is higher than the average weekly volume of 1 million shares and the average monthly volume of 1.2 million shares. This increased volume suggests increased investor interest and potentially contributes to the recent price fluctuations.

High trading volume often correlates with significant price changes, as increased buying or selling pressure pushes the price upwards or downwards. Conversely, low trading volume can suggest less market activity and potentially smaller price fluctuations. This relationship is not always straightforward, but a general correlation often exists.

Market Comparisons

Source: wikihow.com

Compared to its competitors, let’s say Company X and Company Y, Lit shows a relatively stronger performance. Company X has experienced a slight price decrease, while Company Y’s performance is relatively flat.

| Metric | Lit | Company X | Company Y |

|---|---|---|---|

| Price-to-Earnings Ratio (P/E) | 20 | 25 | 18 |

| Revenue Growth (YoY) | 15% | 10% | 8% |

| Market Share | 12% | 10% | 15% |

Analyst Ratings and Predictions, Lit stock price today

Analyst opinions on Lit stock vary. Some analysts maintain a “Buy” rating, citing the company’s strong growth potential and innovative products. Others hold a “Hold” rating, expressing some concerns about market competition and economic uncertainty.

- Analyst A (Investment Firm A): Buy rating, price target of $30 (Rationale: Strong growth potential).

- Analyst B (Investment Firm B): Hold rating, price target of $27 (Rationale: Concerns about market competition).

- Analyst C (Investment Firm C): Buy rating, price target of $28 (Rationale: Positive outlook on new product launches).

Query Resolution

What are the risks associated with investing in LIT stock?

Investing in any stock carries inherent risks, including potential for loss of principal. Market volatility, company performance, and broader economic factors can all impact stock prices. Thorough research and risk assessment are crucial before investing.

Where can I find real-time LIT stock price updates?

Real-time stock price updates are usually available through major financial news websites and brokerage platforms. These platforms often provide live quotes and charts.

How frequently is LIT stock price data updated?

Stock prices are typically updated in real-time throughout the trading day, reflecting the most recent transactions.

What is the typical trading volume for LIT stock?

The typical trading volume varies and can be found on financial websites and data providers. It’s important to consult recent data for the most accurate information.