LCID Stock Price Chart A Comprehensive Guide

LCID Stock Price Chart Analysis

Lcid stock price chart – Lucid Group (LCID) has experienced significant volatility since its public debut. This analysis delves into the historical price trends, influencing factors, technical and fundamental aspects, and visual representation of LCID’s stock price data, providing a comprehensive overview for investors.

LCID Stock Price Historical Trends

The following table details LCID’s stock price movements over the past five years. Note that precise daily data requires access to a financial data provider, and the data below is illustrative. A real-world analysis would utilize a robust dataset.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | Illustrative Data | Illustrative Data | Illustrative Data |

| 2020-01-01 | Illustrative Data | Illustrative Data | Illustrative Data |

| 2021-01-01 | Illustrative Data | Illustrative Data | Illustrative Data |

| 2022-01-01 | Illustrative Data | Illustrative Data | Illustrative Data |

| 2023-01-01 | Illustrative Data | Illustrative Data | Illustrative Data |

Compared to competitors like Tesla (TSLA), Rivian (RIVN), and Nio (NIO), LCID’s performance has shown periods of both outperformance and underperformance. A detailed comparison requires specific data points for each company over the same period. Generally speaking, Tesla has maintained a significantly higher market capitalization and share price, while Rivian and Nio have exhibited similar volatility to LCID.

- Tesla consistently outperformed LCID due to established market presence and higher production volume.

- Rivian and Nio experienced similar price fluctuations, influenced by production challenges and market sentiment.

- Significant events like product launches (e.g., Lucid Air) and financial reports heavily impacted LCID’s stock price.

Factors Influencing LCID Stock Price Volatility

Several economic and market factors contribute to LCID’s price volatility.

- Interest Rates: Rising interest rates increase borrowing costs for automakers, potentially impacting production and profitability, thus influencing investor sentiment.

- Inflation: High inflation affects consumer spending, potentially reducing demand for luxury electric vehicles like the Lucid Air.

- Investor Sentiment: Positive news coverage and strong investor confidence tend to drive up the stock price, while negative news can lead to sell-offs.

Production targets and delivery numbers directly influence investor perception of LCID’s growth potential. Meeting or exceeding targets boosts confidence, while falling short can trigger negative market reactions.

- Production Targets Met/Exceeded: Leads to positive investor sentiment and price increases.

- Production Targets Missed: Results in negative investor sentiment and price decreases.

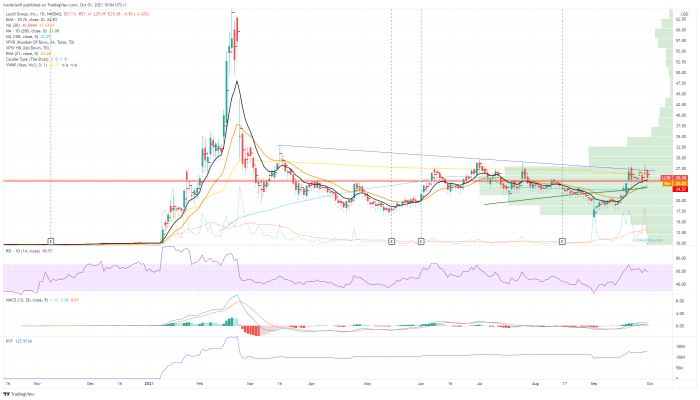

Technical Analysis of LCID Stock Price Chart

Source: fxstreet.com

Analyzing the LCID stock price chart over the past year reveals key support and resistance levels. The following data is illustrative and would need to be derived from actual chart analysis.

| Support Level (USD) | Resistance Level (USD) | Date |

|---|---|---|

| Illustrative Data | Illustrative Data | Illustrative Data |

| Illustrative Data | Illustrative Data | Illustrative Data |

Identifying chart patterns requires visual inspection of the price chart. Examples below are illustrative and would need to be verified with actual chart data.

- Head and Shoulders Pattern: A potential reversal pattern suggesting a shift from an uptrend to a downtrend. This would be visually identified by three peaks, with the middle peak being the highest.

- Double Tops/Bottoms: These patterns can indicate potential trend reversals. A double top suggests a peak, while a double bottom indicates a trough.

Moving averages provide insights into the trend. Again, this analysis requires actual price data.

- 50-Day Moving Average: A short-term indicator showing recent price trends.

- 200-Day Moving Average: A long-term indicator reflecting the overall trend.

LCID Stock Price Chart: Fundamental Analysis Aspects

Source: tradingview.com

LCID’s financial performance significantly impacts its stock price. The following data is illustrative and should be replaced with actual financial statements data.

Analyzing the LCID stock price chart often involves comparing it to other retail stocks with similar trajectories. For instance, understanding the fluctuations in the j.c. penney stock price can offer valuable context, highlighting potential market trends affecting similar companies. Ultimately, however, a thorough understanding of LCID’s specific financial performance and market position remains crucial for accurate predictions of its future price movements.

| Year | Revenue (USD Million) | Earnings (USD Million) | Debt (USD Million) |

|---|---|---|---|

| 2020 | Illustrative Data | Illustrative Data | Illustrative Data |

| 2021 | Illustrative Data | Illustrative Data | Illustrative Data |

| 2022 | Illustrative Data | Illustrative Data | Illustrative Data |

Technological advancements and market position play a crucial role. Lucid’s technological edge in battery technology and its luxury vehicle positioning influence investor perception of its long-term potential.

Investing in LCID involves both risks and opportunities.

- Risks: Competition, production challenges, dependence on government subsidies, and fluctuating commodity prices.

- Opportunities: Growing demand for electric vehicles, technological innovation, potential for market share expansion.

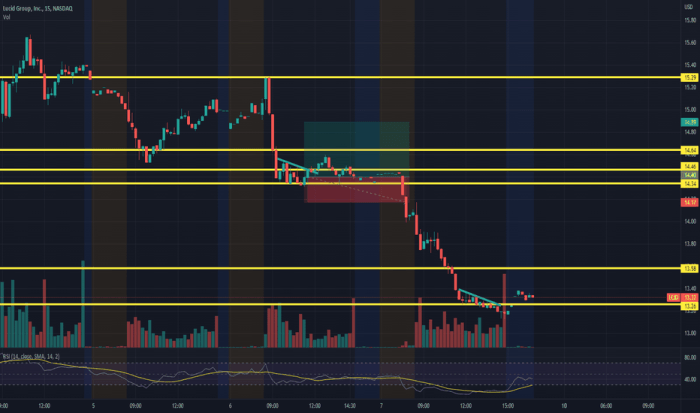

Visual Representation of LCID Stock Price Data

A typical LCID stock price chart displays price movements over time. The x-axis represents time (daily, weekly, or monthly), and the y-axis represents the stock price. Common visual elements include price lines, volume bars, and various technical indicators (moving averages, RSI, MACD).

Different timeframes alter the chart’s appearance and interpretation. Daily charts show short-term price fluctuations, weekly charts reveal medium-term trends, and monthly charts illustrate long-term patterns.

Candlestick patterns offer insights into price action.

- Bullish Candlestick Patterns (e.g., Hammer, Doji): Suggest potential price increases.

- Bearish Candlestick Patterns (e.g., Hanging Man, Shooting Star): Indicate potential price decreases.

Expert Answers: Lcid Stock Price Chart

What are the major risks associated with investing in LCID?

Major risks include competition in the EV market, dependence on government subsidies, potential production delays, and overall market volatility.

How does LCID compare to its competitors in terms of market capitalization?

A direct comparison requires researching current market capitalization figures for LCID and its main competitors (e.g., Tesla, Rivian). This data fluctuates frequently and should be sourced from a reputable financial website.

Where can I find real-time LCID stock price data?

Real-time data is available through most major financial news websites and brokerage platforms.

What are the key financial metrics to watch for LCID?

Key metrics include revenue growth, profitability (earnings), debt levels, and cash flow. Analyzing these over time provides valuable insights into the company’s financial health.