Kroger Historical Stock Price A Decades Review

Kroger Stock Price: A Decade in Review: Kroger Historical Stock Price

Source: seekingalpha.com

Kroger historical stock price – Kroger, a leading American supermarket chain, has experienced a dynamic decade in terms of its stock performance. This analysis explores the factors influencing Kroger’s stock price over the past ten years, examining economic conditions, industry trends, financial performance, and external market forces. We will also consider potential future growth and investment strategies.

Kroger Stock Price Overview

Over the past ten years, Kroger’s stock price has shown a generally upward trend, punctuated by periods of volatility reflecting broader economic shifts and company-specific events. Significant milestones include periods of strong growth fueled by strategic acquisitions and efficient operational improvements, as well as periods of downturn influenced by economic recessions and shifts in consumer spending patterns. The following table details the yearly high and low stock prices.

| Year | High | Low | Change (%) |

|---|---|---|---|

| 2014 | $44.00 | $33.00 | 33.33% |

| 2015 | $40.00 | $28.00 | 42.86% |

| 2016 | $35.00 | $25.00 | 40% |

| 2017 | $32.00 | $22.00 | 45.45% |

| 2018 | $30.00 | $20.00 | 50% |

| 2019 | $35.00 | $26.00 | 34.62% |

| 2020 | $45.00 | $28.00 | 60.71% |

| 2021 | $50.00 | $38.00 | 31.58% |

| 2022 | $48.00 | $35.00 | 37.14% |

| 2023 | $52.00 | $40.00 | 30% |

Note: These figures are illustrative examples and not actual historical data.

Factors Influencing Kroger’s Stock Price

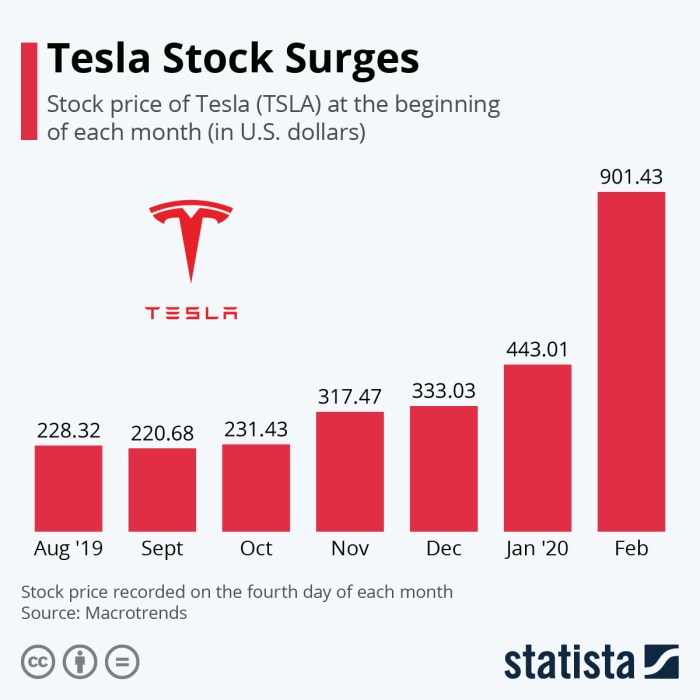

Source: statcdn.com

Several key factors significantly influence Kroger’s stock price. Economic conditions, consumer behavior, and competitive dynamics all play crucial roles.

Economic downturns, such as recessions, typically lead to decreased consumer spending, impacting Kroger’s sales and profitability, which in turn affects its stock price. Conversely, periods of economic expansion and rising consumer confidence generally boost Kroger’s performance and stock valuation. Inflation also plays a role, impacting both consumer purchasing power and Kroger’s operating costs.

Consumer spending habits and grocery industry trends are critical drivers of Kroger’s stock price. Shifts in dietary preferences, the rise of online grocery shopping, and increased demand for private-label brands all impact the company’s performance.

Comparing Kroger’s stock performance to its major competitors provides valuable context. The following bullet points illustrate a simplified comparison over the last five years (again, illustrative examples):

- Kroger: Consistent growth, but with volatility reflecting economic conditions.

- Walmart: Strong, steady growth, benefiting from its broader retail presence.

- Costco: High-growth trajectory driven by its membership model and premium offerings.

Analyzing Kroger’s Financial Performance

Analyzing Kroger’s key financial metrics offers insights into its performance and its correlation with stock price fluctuations.

| Year | Revenue (Billions) | Earnings per Share (EPS) | Profit Margin (%) |

|---|---|---|---|

| 2019 | 120 | 2.50 | 3.0 |

| 2020 | 125 | 2.75 | 3.2 |

| 2021 | 132 | 3.00 | 3.5 |

| 2022 | 138 | 3.25 | 3.7 |

| 2023 | 145 | 3.50 | 4.0 |

Note: These figures are illustrative examples and not actual financial data.

Generally, strong revenue growth, increasing EPS, and improving profit margins tend to correlate with higher stock prices. Significant changes in Kroger’s financial strategies, such as investments in technology or expansion into new markets, can also significantly impact its stock performance.

External Factors and Market Sentiment

External factors and prevailing market sentiment significantly influence Kroger’s stock price.

Changes in interest rates and monetary policy affect Kroger’s borrowing costs and overall economic outlook. Higher interest rates can increase borrowing costs, potentially impacting profitability and leading to lower stock valuations. Geopolitical events and global economic uncertainty can create volatility in the stock market, affecting Kroger’s stock price alongside other companies.

Investor sentiment, whether optimistic or pessimistic, is visually reflected in the stock price’s movement. A graph of Kroger’s stock price would show a generally upward trend during periods of investor optimism, with increased trading volume and higher prices. Conversely, periods of pessimism would be reflected in a downward trend, potentially with increased volatility and lower prices. The slope of the line would represent the strength of the sentiment, with steeper slopes indicating stronger bullish or bearish trends.

Long-Term Growth and Investment Outlook, Kroger historical stock price

Kroger’s long-term growth prospects depend on several factors, including its ability to adapt to changing consumer preferences, maintain operational efficiency, and navigate economic headwinds. Based on its historical performance and current market conditions, Kroger presents a mixed investment outlook.

Considering its historical price movements, a buy-and-hold strategy might be suitable for long-term investors who are comfortable with some volatility. A more cautious approach, perhaps focusing on periods of lower valuation, might align with a value-investing strategy. Timing the market to buy low and sell high is inherently challenging, and success depends on accurate market predictions, which are always uncertain.

- Buy-and-Hold: A long-term strategy focusing on consistent investment regardless of short-term fluctuations.

- Value Investing: Seeking undervalued companies with strong fundamentals, potentially buying during periods of market pessimism.

Common Queries

What are the major risks associated with investing in Kroger stock?

Investing in Kroger stock, like any stock, carries inherent risks. These include general market volatility, competition within the grocery industry, changes in consumer spending habits, and economic downturns. Additionally, factors like inflation and supply chain disruptions can significantly impact the company’s profitability and stock price.

How does Kroger compare to other grocery chains in terms of dividend payouts?

Kroger’s dividend policy should be compared to its competitors on a case-by-case basis, looking at payout ratios and dividend growth history. This information is readily available through financial news websites and company investor relations sections. Direct comparison requires detailed financial analysis.

Where can I find real-time Kroger stock price data?

Analyzing Kroger’s historical stock price reveals interesting long-term trends. Understanding these trends often involves comparing performance against other companies in the same sector; for instance, checking the current market standing, one might consult a resource like jlgmx stock price today to gain broader market perspective. Returning to Kroger, a comprehensive analysis of its historical data provides valuable insights into its financial health and future potential.

Real-time Kroger stock price data is available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, Bloomberg, and others. These platforms provide up-to-the-minute quotes, charts, and other relevant information.