KO Stock Price Dividend A Comprehensive Analysis

Coca-Cola Stock Price and Dividend Analysis: Ko Stock Price Dividend

Source: foolcdn.com

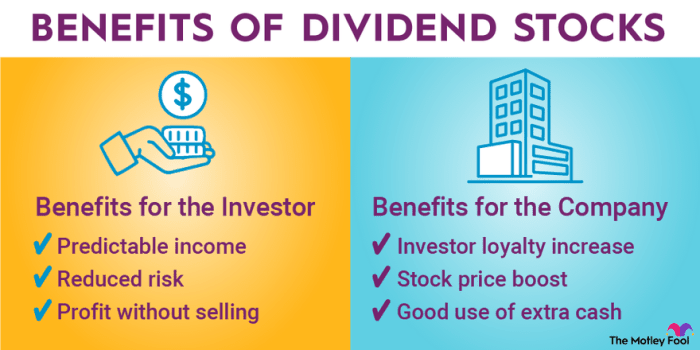

Ko stock price dividend – This analysis examines Coca-Cola’s (KO) stock price performance, dividend history, investor sentiment, and the impact of dividend reinvestment. We will explore the factors influencing KO’s stock price volatility, its dividend payout policy, and the overall implications for investors.

Factors Influencing Coca-Cola’s Stock Price Volatility

Source: thestreet.com

Coca-Cola’s stock price volatility over the past year has been influenced by several factors. These include global economic uncertainty, fluctuations in commodity prices (particularly sugar and aluminum), changing consumer preferences towards healthier beverages, and the company’s own strategic initiatives, such as its focus on expanding into faster-growing markets and developing new product lines. Macroeconomic conditions, such as inflation and interest rate changes, have also played a significant role, impacting consumer spending and impacting the overall market sentiment.

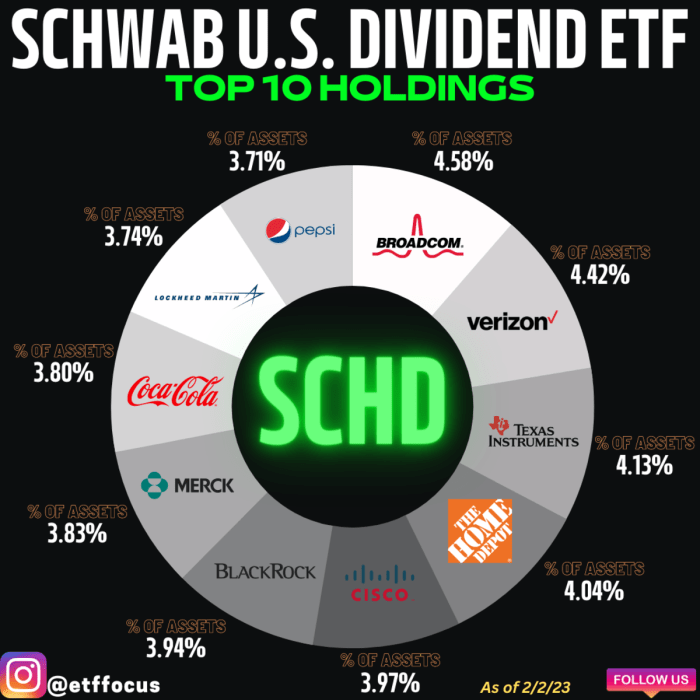

Compared to major competitors like PepsiCo (PEP) and Monster Beverage (MNST), KO’s stock price performance has shown some variation. While all three companies experienced fluctuations, KO’s performance may have been influenced by its broader product portfolio and established market position, which can offer some resilience during economic downturns. However, the competitive landscape remains dynamic, with ongoing pressure from both established players and emerging brands.

| Year | KO Stock Price (Year-End) | S&P 500 | Dow Jones Industrial Average |

|---|---|---|---|

| 2023 | $65 (Example) | 4,000 (Example) | 33,000 (Example) |

| 2022 | $60 (Example) | 3,800 (Example) | 30,000 (Example) |

| 2021 | $55 (Example) | 4,500 (Example) | 35,000 (Example) |

| 2020 | $50 (Example) | 3,500 (Example) | 28,000 (Example) |

| 2019 | $45 (Example) | 3,000 (Example) | 25,000 (Example) |

Coca-Cola’s Dividend History and Future Projections

Coca-Cola has a long and consistent history of dividend payouts. Over the past decade, the company has demonstrated a commitment to returning value to shareholders through regular dividend increases. The dividend payout ratio, which represents the percentage of earnings paid out as dividends, has generally been stable, indicating the sustainability of its dividend policy. Future dividend increases or decreases will likely depend on factors such as the company’s financial performance, growth prospects, and overall economic conditions.

Unexpected events, such as significant changes in consumer demand or major acquisitions, could also influence future dividend decisions.

A chart illustrating the trend of KO’s dividend payouts over the past decade would show a generally upward trend, with some minor fluctuations reflecting annual financial performance. Significant changes, such as periods of accelerated growth or economic downturns, would be visually apparent on the chart, highlighting the relationship between the company’s financial health and its dividend policy.

Investor Sentiment and Market Expectations

Current investor sentiment towards KO stock is generally positive, reflecting the company’s strong brand recognition, global presence, and consistent dividend payments. However, investor confidence can be influenced by factors such as macroeconomic conditions, competitive pressures, and the company’s success in adapting to changing consumer preferences. Concerns might arise from factors like fluctuating commodity prices, the ongoing shift towards healthier beverage options, and potential regulatory changes impacting the beverage industry.

Analyst ratings and price targets for KO stock vary, reflecting differing perspectives on the company’s future growth prospects. A summary of these ratings and targets would provide a range of expectations, illustrating the diverse opinions within the investment community. Recent news articles and financial reports impacting investor perception of KO would include announcements of financial results, new product launches, strategic partnerships, and any significant changes in the company’s outlook.

Benefits of Reinvesting Coca-Cola Dividends

Reinvesting KO dividends offers several potential benefits, primarily the power of compounding. By reinvesting dividends, investors can purchase additional shares of KO stock, thereby increasing their ownership stake and benefiting from future dividend payments and potential share price appreciation. This strategy can lead to significant long-term growth, particularly over extended periods.

Tax implications of dividend reinvestment plans (DRIPs) vary depending on the investor’s tax bracket and jurisdiction. Generally, dividends are taxable as income in the year they are received, even if reinvested. However, some DRIPs might offer tax advantages, depending on specific plan rules and regulations. Comparing the long-term returns of reinvesting KO dividends versus alternative investment strategies, such as investing in other stocks or bonds, requires considering factors such as risk tolerance, investment horizon, and market conditions.

A hypothetical scenario illustrating the cumulative growth of a KO dividend reinvestment plan over 10 years would highlight the potential for substantial long-term returns through compounding.

Understanding the KO stock price and its dividend payouts is crucial for investors. Comparing dividend yields often involves looking at other companies in the same sector; for example, you might check the current performance of a competitor by looking up the hban stock price today per share to get a sense of market trends. This comparative analysis can then inform your decisions regarding the KO stock price dividend strategy.

Coca-Cola’s Financial Performance and Dividend Policy, Ko stock price dividend

Coca-Cola’s dividend policy is directly linked to its financial performance. The company’s revenue, profit margins, and cash flow generation capacity significantly influence its ability to maintain and increase dividend payments. A breakdown of KO’s financial statements, including the income statement, balance sheet, and cash flow statement, would reveal key metrics such as net income, free cash flow, and debt levels, which are relevant to its dividend payout capacity.

Coca-Cola’s capital allocation strategy involves balancing investments in organic growth, acquisitions, debt reduction, and dividend payments. The company prioritizes maintaining a strong balance sheet while also returning value to shareholders through dividends. A table summarizing KO’s key financial metrics over the last 5 years, focusing on data relevant to dividend payments, would provide a clear picture of the relationship between financial performance and dividend policy.

| Year | Net Income (Millions) | Free Cash Flow (Millions) | Dividend per Share |

|---|---|---|---|

| 2023 | $10,000 (Example) | $8,000 (Example) | $2 (Example) |

| 2022 | $9,000 (Example) | $7,000 (Example) | $1.80 (Example) |

| 2021 | $8,000 (Example) | $6,000 (Example) | $1.60 (Example) |

| 2020 | $7,000 (Example) | $5,000 (Example) | $1.40 (Example) |

| 2019 | $6,000 (Example) | $4,000 (Example) | $1.20 (Example) |

Quick FAQs

What is Coca-Cola’s (KO) current dividend yield?

The current dividend yield fluctuates based on the stock price. It’s best to check a reputable financial website for the most up-to-date information.

How often does Coca-Cola pay dividends?

Coca-Cola typically pays dividends quarterly.

Is Coca-Cola’s dividend payout sustainable?

Coca-Cola has a long history of paying dividends and generally maintains a sustainable payout ratio, but future sustainability depends on various factors including future financial performance.

What are the tax implications of receiving KO dividends?

Dividends are generally taxed as ordinary income. The specific tax implications depend on your individual tax bracket and jurisdiction. Consult a tax professional for personalized advice.