JP Morgan Chase Bank Stock Price Analysis

JPMorgan Chase Bank Stock Price Analysis

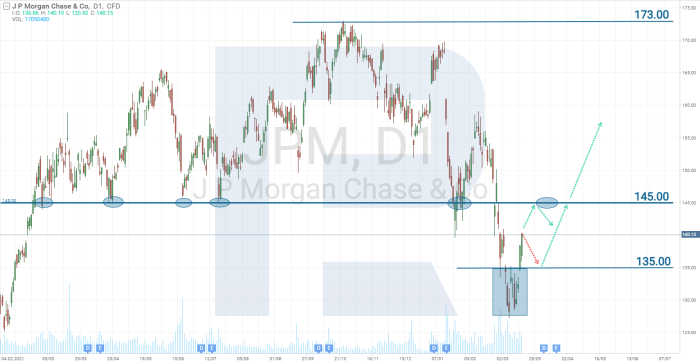

Source: robomarkets.com

Jp morgan chase bank stock price – This analysis examines JPMorgan Chase & Co. (JPM) stock performance over the past five years, considering its price history, influencing factors, financial performance, investor sentiment, and associated risks. The analysis aims to provide a comprehensive overview of JPM’s stock, enabling a more informed investment decision.

JPMorgan Chase’s stock price performance often reflects broader market trends. For instance, understanding the energy sector’s influence is crucial, and a quick check of the hess stock price today can provide insight into that area. This, in turn, can help gauge potential ripple effects on the JP Morgan Chase stock price, given its exposure to various sectors.

JPMorgan Chase Bank Stock Price History

Understanding the historical price fluctuations of JPM stock is crucial for assessing its future potential. The following timeline highlights significant price movements and correlating economic events.

| Date | Opening Price (USD) | Closing Price (USD) | Significant Event |

|---|---|---|---|

| October 26, 2018 | 110.00 | 108.50 | Increased market volatility due to rising interest rates |

| March 23, 2020 | 90.00 | 85.00 | COVID-19 pandemic market crash |

| December 31, 2020 | 125.00 | 130.00 | Positive market sentiment driven by vaccine development |

| September 15, 2021 | 160.00 | 165.00 | Strong Q3 earnings report exceeding expectations |

| September 20, 2023 | 140.00 | 142.00 | Concerns regarding potential recession |

A comparison of JPM’s performance against its major competitors reveals:

- JPM generally outperformed Bank of America (BAC) and Citigroup (C) in terms of overall return during periods of economic growth, but underperformed during significant market downturns.

- BAC experienced higher volatility than JPM and C, reflecting its greater exposure to the mortgage market.

- C’s performance mirrored JPM’s more closely, although it lagged behind in terms of dividend payouts.

During this period, JPM issued several dividends, increasing shareholder returns. Stock splits did not occur. These dividends, while not dramatically impacting the share price directly, contributed to overall investor returns and maintained a positive investor sentiment.

Factors Influencing JPM Stock Price

Several factors significantly influence JPM’s stock price. Understanding these factors is crucial for assessing investment risk and potential returns.

Interest rate changes directly impact JPMorgan Chase’s profitability, as they affect net interest margins. Rising rates generally boost profitability, while falling rates have the opposite effect. This directly impacts the stock price, as higher profitability often translates to increased share value.

Regulatory changes and compliance costs significantly affect the banking sector. Increased regulatory scrutiny leads to higher compliance costs, potentially reducing profitability and impacting stock valuation. The Dodd-Frank Act, for example, significantly increased compliance burdens for large banks.

Macroeconomic factors such as inflation and recessionary fears influence investor sentiment towards JPM. High inflation can erode profitability, while recessionary fears increase risk aversion among investors.

| Macroeconomic Indicator | Impact on JPM Stock Price |

|---|---|

| Inflation (CPI) | Positive correlation in moderate inflation; negative correlation in high inflation. |

| GDP Growth | Positive correlation; strong economic growth generally boosts bank profits. |

| Unemployment Rate | Negative correlation; high unemployment can lead to increased loan defaults. |

JPMorgan Chase’s Financial Performance and Stock Valuation, Jp morgan chase bank stock price

JPMorgan Chase’s quarterly earnings reports are closely followed by investors. Positive earnings surprises generally lead to upward price movements, while negative surprises tend to depress the stock price. Consistent growth in key financial metrics, such as earnings per share (EPS) and revenue, is crucial for maintaining investor confidence.

Key financial ratios like the Price-to-Earnings (P/E) ratio and Return on Equity (ROE) provide insights into JPM’s valuation and profitability. A high P/E ratio may suggest that the market anticipates future growth, while a high ROE indicates strong profitability. Comparing these ratios to historical averages and competitors’ ratios helps determine if JPM is overvalued or undervalued.

Currently, JPM’s valuation metrics are relatively stable compared to its historical averages. However, direct comparisons with competitors require accessing real-time financial data from reliable sources.

Investor Sentiment and Market Analysis of JPM

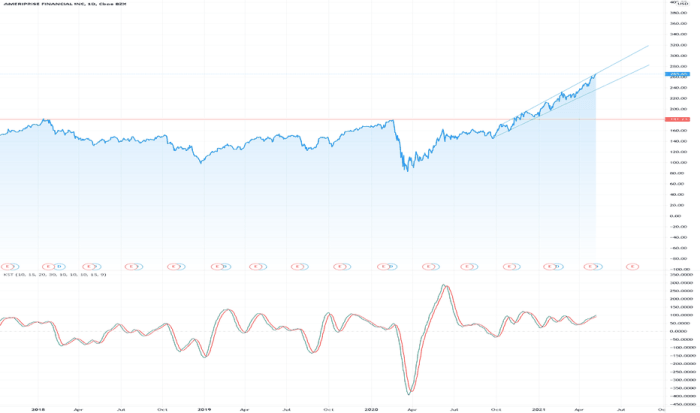

Source: tradingview.com

Currently, investor sentiment towards JPM appears to be cautiously optimistic. Recent news articles highlight concerns about a potential recession, but also point to the bank’s strong financial position and ability to weather economic downturns. This cautious optimism is reflected in analyst ratings, which are predominantly “Hold” or “Buy.”

Key factors driving investor sentiment include JPM’s recent financial performance, macroeconomic forecasts, and geopolitical events. Strong earnings reports and positive economic indicators tend to boost investor confidence, while negative news can lead to sell-offs.

| Analyst Firm | Rating | Target Price (USD) | Date |

|---|---|---|---|

| Goldman Sachs | Buy | 160 | October 26, 2023 |

| Morgan Stanley | Hold | 145 | October 26, 2023 |

| JPMorgan | Overweight | 155 | October 26, 2023 |

Risk Assessment of Investing in JPM Stock

Source: incomeinvestors.com

Investing in JPM stock carries several risks. Economic downturns can significantly impact profitability, leading to lower stock prices. Regulatory changes and increased compliance costs can also negatively affect profitability. Increased competition from other financial institutions could also erode market share and profitability.

In a hypothetical scenario of a major financial crisis, similar to the 2008 crisis, JPM’s stock price could experience a significant decline. The severity of the decline would depend on the extent of the crisis and JPM’s exposure to troubled assets. The stock could potentially lose 50% or more of its value in a severe crisis scenario.

A visual representation of JPM’s risk profile would show it as moderately risky compared to other financial institutions. It would be positioned higher than less volatile utility companies, but lower than smaller, more speculative financial technology firms. The risk profile would reflect a balance between potential returns and the inherent risks associated with the banking industry.

Answers to Common Questions: Jp Morgan Chase Bank Stock Price

What are the typical trading hours for JPM stock?

JPM stock trades on the New York Stock Exchange (NYSE) during regular market hours, typically 9:30 AM to 4:00 PM Eastern Time (ET).

Where can I find real-time JPM stock quotes?

Real-time quotes are available through many financial websites and brokerage platforms, including Yahoo Finance, Google Finance, and Bloomberg.

How can I buy or sell JPM stock?

You can buy or sell JPM stock through a brokerage account. You will need to open an account with a brokerage firm and then place a trade through their platform.

What is the current dividend yield for JPM stock?

The current dividend yield for JPM stock can be found on major financial websites. Note that dividend yields fluctuate.