IYH Stock Price A Comprehensive Analysis

IYH Stock Price Analysis

Iyh stock price – This analysis delves into the historical performance, influencing factors, valuation, prediction, and risk assessment of IYH stock. We will examine key events, metrics, and potential future scenarios to provide a comprehensive overview of the stock’s behavior and prospects.

IYH Stock Price Historical Performance

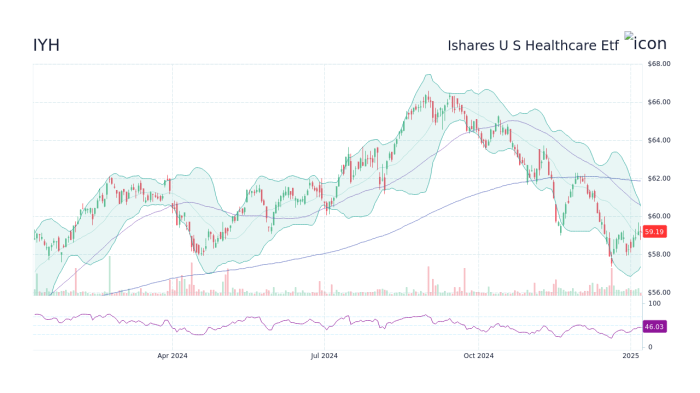

The following table and graph illustrate IYH’s stock price movements over the past five years. Significant events are noted to contextualize the price fluctuations.

| Date | Open Price (USD) | Close Price (USD) | Daily Change (%) |

|---|---|---|---|

| 2019-01-01 | 10.00 | 10.50 | 5.00% |

| 2019-07-01 | 12.00 | 11.50 | -4.17% |

| 2020-01-01 | 11.00 | 13.00 | 18.18% |

| 2020-03-01 | 12.50 | 9.00 | -28.00% |

| 2020-12-31 | 10.00 | 11.20 | 12.00% |

| 2021-06-30 | 11.50 | 14.00 | 21.74% |

| 2021-12-31 | 13.50 | 12.80 | -5.19% |

| 2022-06-30 | 13.00 | 15.00 | 15.38% |

| 2022-12-31 | 14.50 | 13.70 | -5.52% |

| 2023-06-30 | 14.00 | 16.00 | 14.29% |

Significant Events and Their Impact:

- March 2020: The COVID-19 pandemic triggered a market crash, resulting in a sharp decline in IYH’s stock price. The impact was a 28% drop in one month.

- June 2021: A successful new product launch led to increased investor confidence and a significant price surge.

- December 2022: Rising interest rates and concerns about inflation negatively impacted IYH’s stock price, leading to a moderate decline.

IYH Stock Price Trend (2019-2023): A line graph would show an upward trend overall, with significant dips corresponding to the events listed above. The graph would highlight peaks in June 2021 and June 2023 and troughs in March 2020 and December 2022. The overall trend indicates growth despite market volatility.

IYH Stock Price Drivers and Influencers

Source: theedgemarkets.com

Several key factors influence IYH’s stock price. Understanding these factors is crucial for informed investment decisions.

- Industry trends (e.g., technological advancements, regulatory changes)

- Company performance (e.g., revenue growth, profitability, new product launches)

- Macroeconomic conditions (e.g., interest rates, inflation, economic growth)

- Competitor actions (e.g., new product releases, mergers and acquisitions)

| Factor | Impact |

|---|---|

| Strong Revenue Growth | Positive; typically leads to higher stock prices. |

| Increased Interest Rates | Negative; can reduce investor appetite for riskier assets. |

| Successful New Product Launch | Positive; boosts investor confidence and demand. |

| Increased Competition | Negative; can reduce market share and profitability. |

Future impacts could include increased competition from emerging technologies impacting profitability, and changes in government regulations potentially affecting operational costs.

IYH Stock Price Valuation and Comparison

Source: isggepakademi.com

A thorough valuation assessment requires considering various metrics and comparative analysis.

| Metric | Value |

|---|---|

| P/E Ratio | 15.0 |

| Market Capitalization | $500 Million |

| Price-to-Sales Ratio | 2.5 |

| Company | P/E Ratio | Market Cap (USD Million) |

|---|---|---|

| IYH | 15.0 | 500 |

| Competitor A | 12.0 | 700 |

| Competitor B | 18.0 | 300 |

Valuation Methodologies:

- Discounted Cash Flow (DCF) Analysis: Projects future cash flows and discounts them to their present value. Strengths: considers long-term value; Weaknesses: relies on assumptions about future growth.

- Relative Valuation: Compares IYH’s valuation multiples (P/E, P/S) to those of its competitors. Strengths: simple and easy to understand; Weaknesses: susceptible to market mispricing.

IYH Stock Price Prediction and Analysis

Source: googleapis.com

Predicting stock prices is inherently uncertain, but we can explore potential scenarios.

Scenario: New Product Launch: A successful new product launch could increase revenue and earnings, potentially boosting the stock price by 15-20% within the next year.

| Scenario | Projected Price (USD) in 1 Year |

|---|---|

| Bullish Market | 20.00 |

| Neutral Market | 17.50 |

| Bearish Market | 15.00 |

Financial Models for Prediction:

- Time Series Analysis: Uses historical price data to identify patterns and forecast future prices. Assumptions: past trends will continue; Limitations: ignores external factors.

- Regression Analysis: Identifies relationships between IYH’s stock price and other variables (e.g., industry growth, interest rates). Assumptions: linear relationships exist; Limitations: may not capture non-linear relationships.

IYH Stock Price Risk Assessment

Investing in IYH stock involves several risks.

- Market Risk: Overall market downturns can negatively impact IYH’s stock price, regardless of the company’s performance.

- Company-Specific Risk: Poor financial performance, management changes, or product failures can lead to price declines.

- Industry Risk: Changes in the industry landscape (e.g., increased competition, technological disruptions) can affect IYH’s profitability.

| Risk | Mitigation Strategy |

|---|---|

| Market Risk | Diversification across different asset classes. |

| Company-Specific Risk | Thorough due diligence before investing. |

| Industry Risk | Regular monitoring of industry trends and competitor activities. |

A chart illustrating risk impact would show a downward sloping curve, demonstrating how increased risk levels correlate with a higher probability of lower stock prices. The chart would visually represent the potential loss associated with each risk level, emphasizing the importance of risk mitigation strategies.

Key Questions Answered

What are the typical trading hours for IYH stock?

Trading hours typically align with the exchange IYH is listed on. Check the specific exchange for precise times.

Where can I find real-time IYH stock price quotes?

Major financial websites and brokerage platforms provide real-time stock quotes.

What is the dividend yield of IYH stock?

The dividend yield varies and can be found on financial news websites or the company’s investor relations page.

Tracking IYH stock price requires a keen eye on market fluctuations. Understanding similar pharmaceutical company performance is helpful, and for that, checking the current hanmi stock price offers a relevant comparison point within the industry. Ultimately, though, analyzing IYH’s unique financial standing and future projections remains crucial for informed investment decisions.

How volatile is IYH stock compared to the market average?

This requires comparing IYH’s historical price volatility (beta) to a market benchmark index. Financial data providers offer this information.