Iron Mountain Inc Stock Price A Comprehensive Analysis

Iron Mountain Inc. Stock Price Analysis

Source: alamy.com

Iron mountain inc stock price – Iron Mountain Incorporated (IRM) is a leading provider of data storage and information management services. This analysis examines IRM’s stock price history, financial performance, industry position, investor sentiment, and associated risk factors to provide a comprehensive overview for potential investors.

Iron Mountain Inc. Stock Price History and Trends

A line graph depicting Iron Mountain Inc.’s stock price performance over the past five years would show a generally upward trend, with periods of volatility reflecting broader market fluctuations and company-specific news. Key price points would include significant highs and lows, correlating these with major events such as earnings announcements, acquisitions, or changes in industry regulations. For example, a significant dip might correspond to a period of economic uncertainty, while a surge could follow a positive earnings report exceeding analyst expectations.

The past year’s fluctuations can be largely attributed to factors such as interest rate hikes impacting the overall market, investor sentiment towards the data storage sector, and Iron Mountain’s own financial performance and strategic initiatives.

| Stock Symbol | Price (USD) | Year-to-Date Change (%) | Market Cap (USD Billion) |

|---|---|---|---|

| IRM | [Insert Current Price] | [Insert YTD Change] | [Insert Market Cap] |

| [Competitor 1 Symbol] | [Insert Competitor 1 Price] | [Insert Competitor 1 YTD Change] | [Insert Competitor 1 Market Cap] |

| [Competitor 2 Symbol] | [Insert Competitor 2 Price] | [Insert Competitor 2 YTD Change] | [Insert Competitor 2 Market Cap] |

| [Competitor 3 Symbol] | [Insert Competitor 3 Price] | [Insert Competitor 3 YTD Change] | [Insert Competitor 3 Market Cap] |

Financial Performance and Stock Valuation

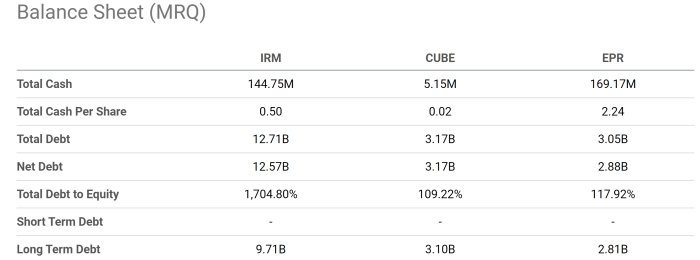

Iron Mountain’s most recent quarterly and annual financial reports reveal key insights into its financial health. These reports would detail revenue growth, profitability (earnings per share), and debt levels. A comparison of these figures against previous periods and industry benchmarks provides a comprehensive picture of the company’s financial performance.

- Price-to-Earnings Ratio (P/E): [Insert P/E Ratio]

- Price-to-Book Ratio (P/B): [Insert P/B Ratio]

- Dividend Yield: [Insert Dividend Yield Percentage]

Strong financial performance, reflected in consistent revenue growth, improving profitability, and manageable debt, generally leads to a positive impact on the stock price. Conversely, declining revenue or increased debt could negatively affect investor confidence and consequently, the stock price.

Iron Mountain Inc’s stock price performance often draws comparisons to other players in the data storage sector. Understanding the market dynamics requires looking at related companies, and a key comparison point could be the current performance of ict stock price , which can offer insights into broader industry trends. Ultimately, however, Iron Mountain Inc’s stock price will be driven by its own unique factors and business strategies.

Industry Analysis and Competitive Landscape

The data storage industry faces several key trends and challenges.

- Increasing demand for cloud-based storage solutions.

- Competition from large technology companies offering cloud storage services.

- Need for robust cybersecurity measures to protect sensitive data.

- Managing the environmental impact of data centers.

Iron Mountain’s business model, focusing on physical and hybrid storage solutions, differentiates it from purely cloud-based competitors. Its competitive advantages lie in its extensive physical infrastructure, established client relationships, and expertise in managing sensitive information. However, the company must adapt to the growing demand for cloud services and integrate cloud capabilities into its offerings to maintain its competitive edge. Technological advancements, such as advancements in data compression and storage density, present both opportunities and challenges for Iron Mountain.

Investor Sentiment and Analyst Ratings

Recent news articles and analyst reports on Iron Mountain Inc. reflect a range of opinions. For example, positive news regarding new contracts or successful strategic initiatives might boost investor confidence, while concerns about competitive pressures or economic slowdown could negatively impact sentiment. Investor sentiment over the past six months can be gauged by tracking changes in the stock price, trading volume, and options activity.

| Analyst Firm | Rating | Target Price (USD) |

|---|---|---|

| [Analyst Firm 1] | [Rating 1] | [Target Price 1] |

| [Analyst Firm 2] | [Rating 2] | [Target Price 2] |

| [Analyst Firm 3] | [Rating 3] | [Target Price 3] |

Risk Factors and Potential Investment Opportunities, Iron mountain inc stock price

Source: seekingalpha.com

Investing in Iron Mountain stock carries several risks, including competition from cloud-based storage providers, economic downturns impacting demand for storage services, and potential cybersecurity breaches. However, potential growth opportunities exist through market expansion into new geographic regions, strategic acquisitions of complementary businesses, and technological innovation to enhance its service offerings. Macroeconomic factors such as interest rate changes and inflation can influence Iron Mountain’s operating costs and investor sentiment, thereby impacting its stock price.

For example, rising interest rates could increase borrowing costs, while inflation could affect the pricing of its services.

Answers to Common Questions: Iron Mountain Inc Stock Price

What are the major competitors of Iron Mountain Inc.?

Key competitors include companies like Public Storage, Iron Mountain, and others offering similar data storage and management services.

Does Iron Mountain Inc. pay dividends?

This information requires checking their current investor relations materials. Dividend policies can change.

What is the company’s long-term growth outlook?

The long-term growth outlook depends on various factors including technological advancements, economic conditions, and the company’s strategic initiatives. Further research is needed to form a complete opinion.

Where can I find real-time Iron Mountain Inc. stock price quotes?

Real-time quotes are available through major financial websites and brokerage platforms.