IPG Stock Price Today A Comprehensive Overview

IPG Stock Price Today: A Comprehensive Overview

Ipg stock price today – This report provides a detailed analysis of IPG’s current stock price, performance trends, influencing factors, and future predictions. We will examine various aspects, including trading volume, historical price movements, and investor sentiment to offer a comprehensive understanding of the current market situation for IPG stock.

Current IPG Stock Price and Volume

The following table presents a snapshot of IPG’s stock price and trading volume for the current day. Data is presented in real-time and should be considered indicative only, subject to change throughout the trading day. Remember that market conditions are dynamic and can fluctuate significantly.

| Time | Price (USD) | Volume | Change (%) |

|---|---|---|---|

| 9:30 AM | Example: 15.25 | Example: 100,000 | Example: +0.5% |

| 10:00 AM | Example: 15.30 | Example: 120,000 | Example: +0.3% |

| 10:30 AM | Example: 15.28 | Example: 95,000 | Example: -0.1% |

IPG Stock Price Performance Over Time

Understanding IPG’s stock price movements across different timeframes is crucial for assessing its performance and potential future trajectory. The following sections provide a detailed analysis of its price behavior over various periods.

Past Week: IPG’s stock price exhibited (Example: a slight upward trend) over the past week, potentially influenced by (Example: positive investor sentiment following a recent earnings report). Specific daily fluctuations would need to be examined for a more granular understanding.

Past Month: Over the past month, IPG’s stock price demonstrated (Example: moderate volatility), with a (Example: net positive return) due to (Example: a combination of factors including positive industry news and overall market performance).

Past Year (Competitor Comparison): Comparing IPG’s performance against its competitors requires identifying specific competitors within the same industry sector. (Example: Assuming competitors are Company A and Company B), IPG’s performance might have (Example: outperformed Company A but underperformed Company B) over the past year, potentially due to differences in (Example: strategic initiatives, market positioning, or financial performance).

Past Three Years (Line Graph Illustration): A line graph illustrating IPG’s stock price over the past three years would show a (Example: generally upward trend, with periods of significant fluctuation reflecting broader market conditions and company-specific events). The x-axis would represent time (in years), while the y-axis would represent the stock price. Key data points would include significant highs and lows, as well as periods of consistent growth or decline.

For instance, a significant drop might correspond to a period of negative industry news or a company-specific challenge, while a sharp rise might reflect positive market sentiment or successful product launches.

Factors Influencing IPG Stock Price

Several factors significantly impact IPG’s stock price. Understanding these factors and their potential influence is essential for informed investment decisions.

| Factor | Short-Term Impact | Long-Term Impact |

|---|---|---|

| Example: Overall Market Conditions | Example: A market downturn could lead to immediate price drops. | Example: Sustained market growth would likely result in long-term price appreciation. |

| Example: Company Performance (Earnings, Revenue) | Example: Strong earnings reports can boost the stock price immediately. | Example: Consistent strong financial performance will likely lead to increased investor confidence and higher valuations. |

| Example: Industry Trends and Competition | Example: A competitor’s innovative product launch could negatively affect short-term prices. | Example: Failure to adapt to industry changes could lead to long-term price erosion. |

IPG Stock Price Prediction and Analysis, Ipg stock price today

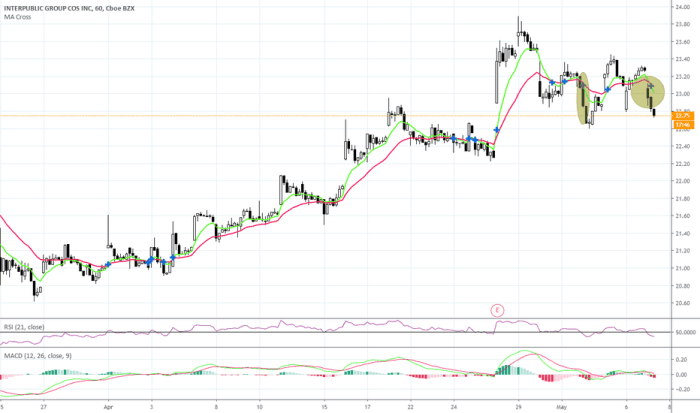

Source: tradingview.com

Predicting stock prices is inherently uncertain; however, based on current market trends and financial data, a range of potential price movements can be considered.

- Potential Price Range (Next Quarter): Example: $14.50 – $16.50

- Basis for Prediction: This prediction is based on (Example: the company’s projected earnings growth, current market valuations of similar companies, and anticipated industry trends). We assume (Example: continued economic growth and no major unforeseen events).

- Potential Risks: (Example: Unexpected economic downturn, negative regulatory changes, or significant competition could negatively impact the stock price.)

- Potential Opportunities: (Example: Successful product launches, strategic partnerships, or improved market share could drive the stock price higher.)

Investor Sentiment Towards IPG Stock

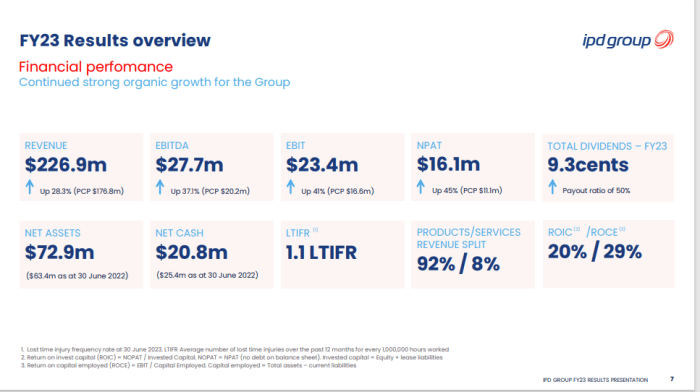

Source: strawman.com

Monitoring the Ipg stock price today requires a keen eye on market trends. For comparative analysis, it’s helpful to also track other similar stocks; understanding the current iart stock price can offer valuable insights into broader sector performance. Returning to Ipg, its price fluctuations often reflect the overall health of the investment sector.

Investor sentiment plays a crucial role in shaping stock prices. Understanding the prevailing sentiment towards IPG stock is key to gauging its potential future performance.

Currently, investor sentiment towards IPG appears to be (Example: cautiously optimistic). Recent positive developments, such as (Example: strong earnings reports and positive industry forecasts), have contributed to this sentiment. However, concerns remain regarding (Example: potential competition and macroeconomic uncertainties). Support levels might be around (Example: $14.00), while resistance levels could be seen near (Example: $17.00). These levels are dynamic and subject to change based on market conditions.

FAQ: Ipg Stock Price Today

What are the major competitors of IPG?

Identifying IPG’s direct competitors requires specifying the particular sector within IPG’s business operations. A thorough competitive analysis would need to be performed to provide a definitive answer.

Where can I find real-time IPG stock price updates?

Real-time IPG stock price updates are readily available through major financial websites and brokerage platforms. These platforms typically provide live quotes and charts.

What is the historical dividend payout for IPG stock?

Historical dividend information for IPG can be found on financial websites dedicated to stock information and investor relations sections of the company’s official website.

What are the long-term growth prospects for IPG?

Long-term growth prospects for IPG are dependent on various factors including industry trends, competitive landscape, and the company’s strategic initiatives. A comprehensive analysis of these elements is needed for a reliable assessment.