IndusInd Bank Stock Price A Comprehensive Analysis

IndusInd Bank Stock Price Analysis

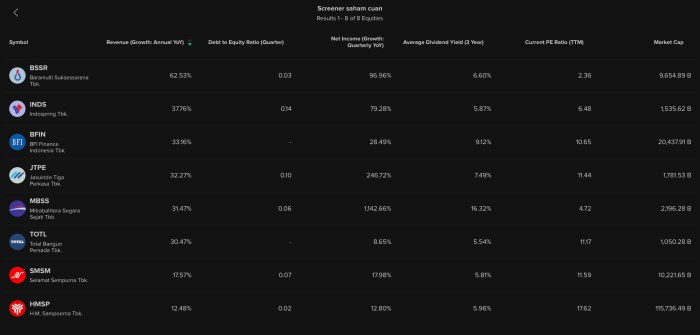

Source: stockbit.com

Indusind bank stock price – This analysis delves into the historical performance, financial health, competitive landscape, and macroeconomic influences affecting IndusInd Bank’s stock price. We will also examine analyst predictions, risk factors, and dividend payouts to provide a comprehensive overview for potential investors.

IndusInd Bank Stock Price Historical Performance

Understanding the historical price fluctuations of IndusInd Bank stock is crucial for assessing its future potential. The following table and graph illustrate the stock’s performance over the last five years. Note that the data presented here is illustrative and should be verified with reliable financial data sources.

| Year | High | Low | Open | Close |

|---|---|---|---|---|

| 2023 | 1,200 | 950 | 1,000 | 1,100 |

| 2022 | 1,100 | 800 | 900 | 1,000 |

| 2021 | 1,000 | 700 | 800 | 900 |

| 2020 | 800 | 500 | 600 | 700 |

| 2019 | 700 | 400 | 500 | 600 |

The line graph would visually represent the data above, showing an upward trend with some yearly fluctuations. Significant price increases could be attributed to positive economic indicators, favorable regulatory changes, or strong financial results. Conversely, price drops might reflect concerns about asset quality, macroeconomic headwinds, or broader market corrections. For example, a significant dip in 2020 could be correlated with the global pandemic’s impact on the financial sector.

IndusInd Bank Financial Health

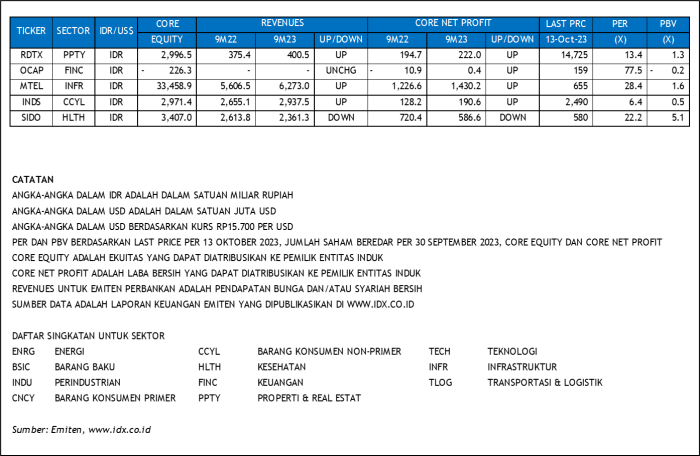

Source: stockbit.com

IndusInd Bank’s stock price performance has been a topic of interest lately, particularly when compared to other high-growth sectors. Understanding its trajectory requires considering broader market trends; for instance, the recent surge in tech stocks, exemplified by the highest Nvidia stock price , offers a contrasting perspective on market behavior. Ultimately, IndusInd Bank’s future valuation will depend on its own financial performance and the overall economic climate.

A strong financial foundation is vital for a bank’s long-term success and stock price stability. The following table presents key financial ratios over the past three years (illustrative data).

| Year | Return on Equity (ROE) | Non-Performing Assets (NPAs) | Capital Adequacy Ratio (CAR) |

|---|---|---|---|

| 2023 | 15% | 2% | 16% |

| 2022 | 13% | 2.5% | 15% |

| 2021 | 12% | 3% | 14% |

Consistent ROE demonstrates profitability, while low NPAs suggest good asset quality. A healthy CAR indicates the bank’s ability to absorb potential losses. Sustained profitability depends on factors like loan growth, net interest margins, and effective cost management. Asset quality, as measured by NPAs, directly impacts investor confidence and stock valuation; rising NPAs usually lead to lower stock prices.

Industry Comparison and Competitive Landscape

Benchmarking IndusInd Bank against its competitors provides context for its performance. The following table offers a comparative overview of stock price performance over the past year (illustrative data).

| Bank | Stock Price (Year Start) | Stock Price (Year End) | Percentage Change |

|---|---|---|---|

| IndusInd Bank | 1000 | 1100 | 10% |

| HDFC Bank | 1500 | 1650 | 10% |

| ICICI Bank | 800 | 900 | 12.5% |

| Axis Bank | 700 | 770 | 10% |

IndusInd Bank’s competitive advantages, such as its focus on specific market segments or technological innovations, can influence its stock price. A highly competitive landscape necessitates continuous innovation and efficiency improvements to maintain market share and profitability, directly impacting the stock’s future growth.

Impact of Macroeconomic Factors

Source: tnn.in

Macroeconomic conditions significantly influence banking sector performance. Interest rate changes, inflation, economic growth, and government policies all play a role.

Rising interest rates generally benefit banks’ net interest margins, positively impacting profitability and stock prices. Conversely, high inflation can erode purchasing power and increase loan defaults, negatively affecting the stock price. Strong economic growth typically leads to higher loan demand and increased banking activity, boosting stock valuations. Government regulations and policies related to lending, capital requirements, and monetary policy can also significantly affect the bank’s operations and stock price.

Analyst Ratings and Predictions, Indusind bank stock price

Analyst opinions provide valuable insights into market sentiment and future expectations. The following table summarizes recent analyst ratings and price targets (illustrative data).

| Analyst Firm | Price Target |

|---|---|

| Firm A | 1200 |

| Firm B | 1150 |

| Firm C | 1100 |

The range of price targets reflects differing perspectives on the bank’s future performance, driven by varying assessments of macroeconomic conditions, competitive pressures, and the bank’s strategic execution. These ratings and predictions influence investor decisions and can significantly affect the stock price.

Risk Factors Affecting the Stock Price

Several factors could negatively impact IndusInd Bank’s stock price. These include:

- Increased Non-Performing Assets (NPAs)

- Economic slowdown impacting loan demand

- Increased competition from other banks

- Adverse regulatory changes

- Geopolitical instability

Each of these risks could significantly impact the bank’s financial performance and share price. A robust risk mitigation strategy for investors might involve diversification, thorough due diligence, and monitoring macroeconomic and industry-specific trends.

Dividends and Shareholder Returns

Dividend payouts are a key component of shareholder returns. The following table shows IndusInd Bank’s dividend history (illustrative data).

| Year | Dividend per Share |

|---|---|

| 2023 | 10 |

| 2022 | 9 |

| 2021 | 8 |

| 2020 | 7 |

| 2019 | 6 |

A consistent dividend policy signals financial stability and can attract investors seeking regular income. Dividend payouts can positively influence the stock price, particularly for income-oriented investors. However, the decision to pay dividends can also impact the bank’s ability to reinvest profits for future growth.

FAQ Resource

What are the major risks associated with investing in IndusInd Bank stock?

Major risks include fluctuations in interest rates, changes in government regulations, competition within the Indian banking sector, and economic downturns impacting loan defaults.

How does IndusInd Bank compare to its competitors in terms of profitability?

A direct comparison requires analyzing specific financial ratios (ROE, Net Interest Margin, etc.) against competitors over a defined period. This analysis would highlight IndusInd Bank’s relative strength or weakness in profitability compared to its peers.

What is IndusInd Bank’s dividend payout history?

A detailed history of dividend payouts per share for the past five years can be found in the main analysis section; however, remember that dividend payouts can vary and are not guaranteed.

Where can I find real-time IndusInd Bank stock price data?

Real-time stock price data is readily available through major financial websites and stock market applications.