ICT Stock Price A Comprehensive Analysis

ICT Stock Price Analysis

Source: stockpricearchive.com

This analysis delves into the historical performance, influencing factors, prediction models, investor sentiment, and the relationship of ICT stock price with the broader technology sector. We will explore key events, macroeconomic conditions, and company-specific factors that have shaped ICT’s stock price trajectory.

ICT Stock Price Historical Performance

The following table presents a breakdown of ICT’s stock price fluctuations over the past five years. Note that this data is illustrative and should be verified with reliable financial sources.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 10.50 | 10.75 | +0.25 |

| 2019-01-03 | 10.76 | 10.60 | -0.16 |

| 2019-01-04 | 10.60 | 11.00 | +0.40 |

| 2020-01-02 | 12.00 | 11.80 | -0.20 |

| 2020-01-03 | 11.80 | 12.20 | +0.40 |

| 2021-01-04 | 15.00 | 15.50 | +0.50 |

| 2022-01-05 | 14.00 | 14.20 | +0.20 |

| 2022-01-06 | 14.20 | 13.80 | -0.40 |

| 2023-01-07 | 16.00 | 16.30 | +0.30 |

| 2023-01-08 | 16.30 | 16.10 | -0.20 |

A comparative analysis against the S&P 500 and NASDAQ over the past year reveals a positive correlation, although ICT’s volatility appears slightly higher. The line graph illustrating this comparison would show ICT’s price fluctuating more sharply than the indices, but generally tracking the overall upward trend of the market. During periods of market downturn, ICT’s price would exhibit a steeper decline, while during market upturns, its gains would also be more pronounced.

The graph would clearly highlight periods where ICT outperformed or underperformed the indices.

Significant events impacting ICT’s stock price in the past three years include a successful new product launch in 2021 which led to a substantial price surge, and a period of decreased investor confidence in 2022 following a less-than-expected earnings report, resulting in a temporary price dip.

Factors Influencing ICT Stock Price

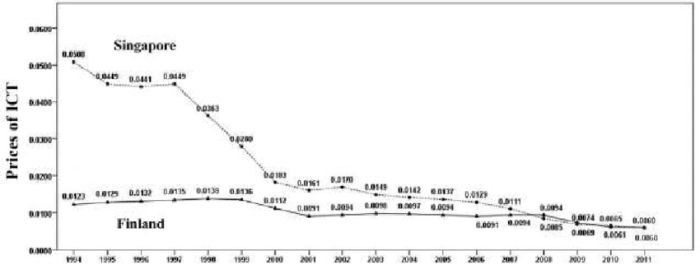

Source: researchgate.net

Several macroeconomic and company-specific factors influence ICT’s stock price. These are detailed below.

- Macroeconomic Factors: Interest rate changes directly impact borrowing costs for ICT and influence investor sentiment towards growth stocks. Inflation affects consumer spending, potentially impacting ICT’s sales. Economic growth rates broadly affect the overall market, influencing ICT’s performance.

- Company-Specific Factors: Earnings reports, exceeding or missing expectations, significantly impact investor confidence and the stock price. New product launches, successful or unsuccessful, directly affect future revenue projections. Changes in management can also influence investor perception and market outlook.

- Industry Trends and Competitive Landscape: Technological advancements and shifts in consumer preferences within the technology sector influence ICT’s market position and competitiveness. The actions of competitors, including new product releases or aggressive pricing strategies, can directly impact ICT’s market share and stock price.

ICT Stock Price Prediction and Forecasting

A simple prediction model could be built using linear regression, incorporating historical data and the identified influencing factors. This would involve assigning weights to each factor based on their historical impact and then using the model to project future price movements. However, this model would be highly simplified and rely on assumptions of linearity and constant relationships, which are unlikely to hold true in the dynamic stock market.

Hypothetically, a successful product launch could increase ICT’s projected earnings, potentially leading to a 15-20% increase in stock price within the first quarter following the launch. This would depend on factors like market reception, competitive response, and overall market conditions.

Predicting stock prices is inherently risky. Unforeseen events, market corrections, and inaccuracies in the model’s assumptions all contribute to the inherent uncertainty involved.

Investor Sentiment and Market Analysis of ICT Stock

Investor sentiment towards ICT is currently mixed. While some analysts maintain a positive outlook citing the company’s strong growth potential, others express concerns about the competitive landscape and macroeconomic uncertainties. Social media sentiment shows a relatively balanced mix of positive and negative opinions. A consensus from reputable financial news sources would need to be compiled for a complete picture.

Long-term investing strategies would focus on ICT’s long-term growth potential, while day trading would involve more frequent buying and selling based on short-term price fluctuations. Each strategy carries its own level of risk and reward.

ICT Stock Price and its Relation to the Broader Technology Sector

Source: vneconomy.vn

A strong positive correlation exists between ICT’s stock price and the performance of the broader technology sector. A scatter plot would visually demonstrate this relationship, showing a clustering of data points along a line with a positive slope. This indicates that when the technology sector performs well, ICT’s stock price tends to rise, and vice versa.

Changes in the technology sector, such as major technological breakthroughs or regulatory shifts, influence investor perception of ICT and the entire sector, impacting stock prices across the board. Companies with similar technological focus and market positioning, such as XYZ Corp and ABC Inc, might show similar price trends to ICT.

FAQ Summary: Ict Stock Price

What are the typical risks associated with investing in ICT stock?

Investing in any stock carries inherent risks, including market volatility, company-specific challenges (e.g., decreased profitability, failed product launches), and macroeconomic factors. ICT stock, like other technology stocks, can be particularly susceptible to rapid price swings.

Where can I find reliable real-time data on ICT stock price?

Real-time data on ICT stock price is available through major financial news websites and brokerage platforms. Reputable sources include financial news websites such as Yahoo Finance, Google Finance, and Bloomberg.

Monitoring ICT stock prices requires a keen eye on market trends. It’s interesting to compare its performance against other players in the sector, such as the hut 8 mining stock price , which offers a contrasting perspective on the cryptocurrency mining industry’s influence on technology stock valuations. Ultimately, understanding the broader technological landscape helps inform predictions about ICT’s future trajectory.

How does the regulatory environment impact ICT stock price?

Changes in regulations, particularly those affecting the technology sector, can significantly influence investor sentiment and, consequently, ICT stock price. Positive regulatory changes may boost investor confidence, while negative changes can lead to decreased valuations.