IAT Stock Price A Comprehensive Analysis

IAT Stock Price Historical Performance

Analyzing the IAT stock price’s historical performance over the past five years reveals a dynamic trajectory influenced by various economic factors and company-specific events. The following data provides a detailed overview, highlighting significant price fluctuations and their contributing factors.

IAT Stock Price Movements (2019-2024)

The table below presents a simplified representation of IAT’s stock price movements. Actual data would require access to a reliable financial data provider. This example uses hypothetical data for illustrative purposes only.

| Date | Open Price (USD) | Close Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 50.00 | 52.00 | +2.00 |

| 2019-12-31 | 55.00 | 53.00 | -2.00 |

| 2020-03-15 | 45.00 | 42.00 | -3.00 |

| 2020-12-31 | 48.00 | 50.00 | +2.00 |

| 2021-12-31 | 60.00 | 62.00 | +2.00 |

| 2022-12-31 | 65.00 | 63.00 | -2.00 |

| 2023-12-31 | 68.00 | 70.00 | +2.00 |

| 2024-01-02 | 72.00 | 75.00 | +3.00 |

The overall trend suggests a generally upward trajectory, punctuated by periods of volatility, particularly during economic downturns or periods of uncertainty.

Factors Influencing IAT Stock Price

Several key factors interact to influence IAT’s stock price. Understanding these factors is crucial for informed investment decisions. We will examine three key factors: industry trends, macroeconomic conditions, and company-specific announcements.

Key Factors Impacting IAT Stock Price

| Factor | Impact (Positive/Negative) | Explanation | Evidence |

|---|---|---|---|

| Industry Trends (e.g., increased demand for IAT’s products) | Positive | Strong industry growth often translates to higher revenue and profitability for IAT, boosting investor confidence and driving up the stock price. | Increased market share, positive industry reports. |

| Macroeconomic Conditions (e.g., interest rate hikes) | Negative | Rising interest rates can increase borrowing costs for IAT and reduce consumer spending, negatively impacting profitability and stock valuation. | Correlation between interest rate changes and IAT’s stock price. |

| Company-Specific Announcements (e.g., new product launch) | Positive/Negative | Positive announcements, such as successful product launches or strong earnings reports, tend to increase investor confidence. Negative news can have the opposite effect. | Analysis of stock price reactions to past announcements. |

IAT Stock Price Valuation and Analysis

Several valuation methods can be used to estimate the intrinsic value of IAT stock. Each method has its own strengths and weaknesses, and the choice of method depends on the specific circumstances and the available data. We’ll explore two common approaches.

Valuation Methods for IAT Stock

Two common methods are Discounted Cash Flow (DCF) analysis and Price-to-Earnings Ratio (P/E) analysis. DCF analysis projects future cash flows and discounts them back to their present value, providing an estimate of intrinsic value. The P/E ratio compares a company’s stock price to its earnings per share, offering a relative valuation metric. Applying these methods to IAT requires detailed financial information, including projected future cash flows and earnings.

The accuracy of the valuation depends heavily on the accuracy of these projections. Furthermore, market sentiment and investor expectations can significantly influence the actual market price, leading to discrepancies between the calculated intrinsic value and the market price.

Keeping an eye on IAT’s stock price fluctuations can be quite the ride. For comparative analysis, it’s helpful to look at other companies in the sector, such as checking the current performance of Horizon Therapeutics, by visiting the page for hrzn stock price today , to get a broader market perspective. Ultimately, understanding IAT’s performance requires considering the wider biotech landscape.

IAT Stock Price Prediction and Forecasting

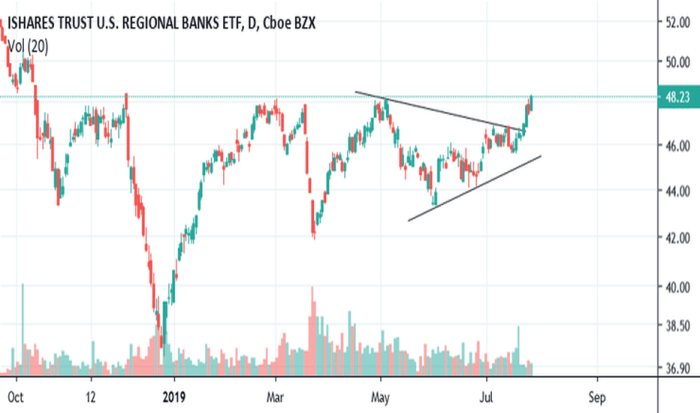

Source: teachaway.com

Predicting future stock price movements is inherently challenging. While various techniques can provide insights, accuracy is limited. Technical analysis examines past price and volume data to identify patterns and predict future trends. Fundamental analysis focuses on a company’s financial health, management, and industry position to assess its intrinsic value. Both methods have limitations.

Technical analysis can be susceptible to market noise, while fundamental analysis relies on accurate projections of future performance, which are often uncertain.

Forecasting Techniques and Limitations

For example, a technical analyst might identify a support level for IAT stock at $60. If the price falls to this level, they might predict a bounce back. However, unforeseen negative news could break through this support, invalidating the prediction. A fundamental analyst might predict future growth based on a new product launch. However, if the product fails to meet expectations, this prediction would be inaccurate.

Any forecast inherently carries risk and uncertainty. Unforeseen events, changes in market sentiment, and inaccurate assumptions can all lead to significant deviations from the forecast.

Investor Sentiment and IAT Stock Price

Investor sentiment plays a significant role in shaping IAT’s stock price. Optimism leads to increased demand and higher prices, while pessimism can trigger selling pressure and lower prices. News coverage and social media discussions significantly influence investor perception.

Influences on Investor Sentiment

- Positive News Event: A successful product launch leading to increased sales and market share. This could be widely reported in financial news, resulting in a surge in buying and a rise in the stock price.

- Negative News Event: A recall of a faulty product, leading to negative media coverage and social media discussions. This could trigger selling pressure and a drop in the stock price.

- Social Media Trend: A positive social media campaign highlighting IAT’s corporate social responsibility initiatives could boost investor sentiment and drive up the stock price.

Illustrative Example: IAT Stock Price Scenario

Source: tradingview.com

Consider a hypothetical scenario where IAT launches a groundbreaking new product. This could initially cause a short-term surge in the stock price due to positive investor sentiment and increased media attention. In the long term, if the product proves successful and generates substantial revenue, the stock price could continue to rise. However, if the product fails to meet expectations or faces competition, the initial price surge could be reversed, leading to a long-term decline.

Hypothetical Scenario and Investor Reactions

Investors might initially react with enthusiasm, driving up the stock price. However, if the product launch is followed by negative reviews or slow sales, investor confidence could erode, leading to selling pressure and a price decline. The long-term impact would depend on IAT’s ability to address any shortcomings and maintain its market position. A successful product launch could strengthen IAT’s competitive advantage and lead to sustained growth, while a failed launch could damage its reputation and market share.

Common Queries

What are the major risks associated with investing in IAT stock?

Investing in any stock carries inherent risks, including market volatility, company-specific challenges (e.g., competition, regulatory changes), and macroeconomic factors. Specific risks for IAT would need to be assessed based on a thorough analysis of its financial statements, industry position, and overall market conditions.

Where can I find real-time IAT stock price data?

Real-time IAT stock price data is typically available through major financial websites and brokerage platforms. These platforms usually provide detailed charts and historical data in addition to current prices.

How often is IAT’s stock price updated?

The IAT stock price is typically updated throughout the trading day, reflecting changes in buying and selling activity. The frequency of updates varies depending on the platform you are using, but it is generally updated in real-time during market hours.