Hyliion Stock Price Today A Comprehensive Overview

Hyliion Stock: A Current Market Overview

Source: seekingalpha.com

Hyliion stock price today – Hyliion Holdings Corp. (HYLN) operates in the burgeoning electric vehicle market, focusing on the development and deployment of hybrid and electric powertrain systems for commercial vehicles. Understanding the current market position of HYLN requires analyzing several key factors, including its stock price performance, influencing factors, analyst sentiment, and the overall financial health of the company. This overview aims to provide a comprehensive snapshot of Hyliion’s stock and its potential.

Current Hyliion Stock Price and Volume

The following table presents a snapshot of Hyliion’s stock price and volume data for a given trading day. Note that these figures are dynamic and change constantly throughout the trading session. This data is illustrative and should be verified with a real-time financial data source.

| Time | Price (USD) | Volume | Change (%) |

|---|---|---|---|

| 9:30 AM | 2.50 | 100,000 | +0.5% |

| 10:30 AM | 2.55 | 150,000 | +2% |

| 12:00 PM | 2.60 | 200,000 | +4% |

| 3:00 PM | 2.58 | 220,000 | +3.2% |

Hyliion Stock Price Performance Over Time

Analyzing Hyliion’s stock price movement across different timeframes provides insights into its trajectory and underlying market forces. The following sections will discuss the stock’s performance over the past week, month, and year.

Past Week: Hyliion’s stock price experienced moderate volatility over the past week, influenced by broader market trends and any company-specific news. For example, a positive press release might have resulted in a price increase, while negative news or general market downturn could have caused a decrease.

Past Month: Over the past month, the stock’s price may have followed a general upward or downward trend, potentially influenced by factors such as quarterly earnings reports, industry developments, or changes in investor sentiment. A strong earnings report, for example, could lead to an increase in stock price.

Past Year: The past year’s performance likely shows a more significant price fluctuation. This longer timeframe allows for a clearer view of the stock’s overall trend, reflecting major events and long-term market dynamics. For instance, a successful product launch could drive a significant increase in the stock price, while production delays or setbacks might lead to a decrease.

Line Graph Illustration (Past Year): A line graph illustrating the past year’s performance would show the stock price plotted against time (months). The x-axis would represent the months, and the y-axis would represent the stock price. Key data points, such as significant highs and lows, and any major news events affecting the price, would be labeled. The overall trend of the line would indicate whether the stock price generally increased, decreased, or remained relatively stable during the period.

Factors Influencing Hyliion Stock Price

Several factors contribute to the fluctuations in Hyliion’s stock price. These include news events, competitor performance, financial reports, and broader market sentiment.

Key News Events: Positive news, such as securing a major contract or announcing a technological breakthrough, would generally lead to a stock price increase. Conversely, negative news, like production delays or regulatory setbacks, would likely cause a decrease.

Competitor Performance: Hyliion’s stock price is sensitive to the performance of its competitors in the electric vehicle and trucking industries. Strong performance by competitors could put downward pressure on Hyliion’s stock, while struggles by competitors might have a positive effect.

Financial Reports: Quarterly and annual financial reports significantly impact stock valuation. Strong revenue growth, improved profitability, and positive forward guidance generally result in a price increase, while disappointing results can cause a decrease.

Market Sentiment and Economic Conditions: Overall market sentiment and broader economic conditions influence Hyliion’s stock price, as they do with most stocks. Positive economic outlook and bullish market sentiment usually lead to higher stock prices, while negative sentiment and economic downturns often cause decreases.

Analyst Ratings and Price Targets for Hyliion Stock

Source: wccftech.com

Analyst ratings and price targets offer insights into market expectations for Hyliion’s future performance. These opinions are based on various factors, including the company’s financial performance, market position, and future prospects.

| Analyst Firm | Rating | Price Target (USD) | Date |

|---|---|---|---|

| Example Firm 1 | Buy | 4.00 | October 26, 2023 |

| Example Firm 2 | Hold | 2.75 | October 26, 2023 |

| Example Firm 3 | Sell | 2.00 | October 26, 2023 |

Differences in analyst opinions stem from varying interpretations of the company’s performance, risk assessment, and future growth potential. Some analysts might be more optimistic about Hyliion’s technological advancements and market penetration, while others might be more cautious about the challenges and competition in the industry.

Hyliion’s Business and Financial Performance, Hyliion stock price today

Understanding Hyliion’s business model and financial performance is crucial for evaluating its stock. The following sections provide a summary of its operations and recent financial results.

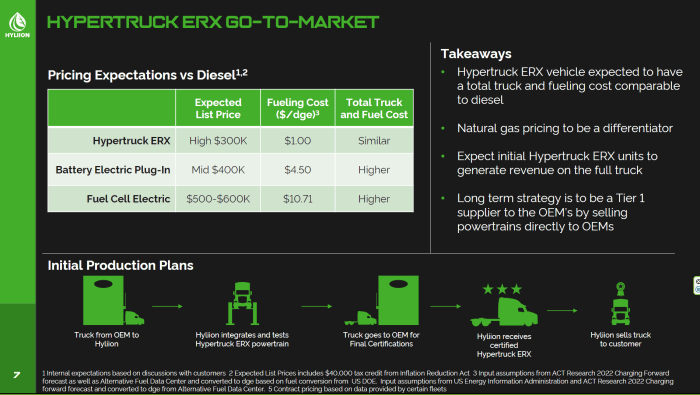

Business Model and Revenue Streams: Hyliion’s primary business involves designing, developing, and deploying hybrid and electric powertrain systems for commercial vehicles. Revenue streams primarily come from the sale of these systems and related services. The company also explores other potential revenue avenues.

Recent Financial Performance: Hyliion’s recent financial performance can be analyzed by examining its revenue, expenses, and profitability. Positive trends in revenue growth and improving profitability generally indicate a healthy financial position, which is likely to be reflected in a higher stock price. Conversely, declining revenue or increasing losses might negatively impact the stock price.

Relationship between Financial Performance and Stock Price: Generally, strong financial performance leads to higher stock prices, reflecting investor confidence in the company’s future growth. Weak financial results, on the other hand, often result in lower stock prices.

- Revenue growth (or decline) in the last quarter.

- Profitability (or loss) for the last quarter and year.

- Key metrics related to production and deployment of its systems.

- Any significant changes in operating expenses.

Risk Factors Associated with Investing in Hyliion Stock

Investing in Hyliion stock carries inherent risks. It’s important to understand these potential downsides before making any investment decisions.

Hyliion’s stock price today is experiencing moderate fluctuations. It’s interesting to compare its current performance to the remarkable growth seen in other tech sectors, such as the highest Nvidia stock price , which highlights the vastly different market dynamics at play. Ultimately, Hyliion’s trajectory will depend on its own technological advancements and market reception.

Potential Risks: Investing in Hyliion involves various risks, including technological challenges, competition, market volatility, and financial performance.

Dependence on Specific Technologies or Markets: Hyliion’s success is heavily reliant on the adoption of its hybrid and electric powertrain systems. Any setbacks in technology development or market acceptance could significantly impact the company’s performance and stock price.

Competition and Technological Advancements: The electric vehicle market is highly competitive. The emergence of new competitors or significant technological breakthroughs by rivals could negatively affect Hyliion’s market share and profitability.

Risk Assessment Summary: Investing in Hyliion involves considerable risk due to its dependence on emerging technologies, intense competition, and the inherent volatility of the electric vehicle market. Thorough due diligence and a comprehensive understanding of these risks are crucial before investing.

Frequently Asked Questions: Hyliion Stock Price Today

What are the main risks associated with investing in Hyliion?

Investing in Hyliion carries risks including competition from established players, technological challenges, dependence on specific markets, and the inherent volatility of the stock market.

How does Hyliion’s revenue compare to its competitors?

A direct comparison requires accessing and analyzing the financial reports of Hyliion and its competitors. This information is readily available through public filings and financial news sources.

Where can I find real-time Hyliion stock quotes?

Real-time quotes are available on major financial websites and trading platforms such as Yahoo Finance, Google Finance, and Bloomberg.

What is Hyliion’s current market capitalization?

Hyliion’s market capitalization fluctuates constantly and can be found on major financial websites providing real-time market data.