How a Stock Price Is Determined

Fundamental Analysis

Source: slideserve.com

How a stock price is determined – Fundamental analysis delves into a company’s financial health and operational efficiency to assess its intrinsic value. This approach focuses on factors that directly impact a company’s profitability and long-term sustainability, ultimately influencing its stock price.

Company Earnings and Stock Price

A company’s earnings, specifically net income, are a key driver of its stock price. Strong earnings growth typically signals a healthy and profitable business, attracting investors and pushing the stock price upward. Conversely, disappointing earnings often lead to a decline in price, as investors reassess the company’s prospects.

Revenue Growth and Investor Sentiment

Consistent revenue growth indicates a company’s ability to expand its market share and generate increasing sales. This positive trend fosters investor confidence and often results in a higher stock valuation. Conversely, declining or stagnant revenue can negatively impact investor sentiment and lead to lower stock prices.

Price-to-Earnings Ratio (P/E) and Stock Valuation

The price-to-earnings ratio (P/E) is a crucial valuation metric. It represents the market’s valuation of a company relative to its earnings per share. A high P/E ratio suggests investors expect strong future growth, while a low P/E ratio might indicate undervaluation or lower growth expectations. Comparing a company’s P/E ratio to its industry peers provides valuable context for its valuation.

Debt Levels and Stock Price Influence

High levels of debt can significantly impact a company’s stock price. Excessive debt increases financial risk, potentially hindering the company’s ability to invest in growth or weather economic downturns. Investors often react negatively to increasing debt burdens, leading to lower stock valuations. Conversely, a reduction in debt can signal financial stability and boost investor confidence.

Valuation Metrics Comparison

The following table compares the valuation metrics of three hypothetical companies in the technology industry. Note that these are illustrative examples and not representative of any specific real-world companies.

| Company | P/E Ratio | Revenue Growth (YoY) | Debt-to-Equity Ratio |

|---|---|---|---|

| TechCorp | 25 | 15% | 0.5 |

| Innovate Inc. | 30 | 20% | 0.3 |

| Data Solutions | 18 | 8% | 0.7 |

Technical Analysis: How A Stock Price Is Determined

Technical analysis focuses on historical price and volume data to identify patterns and predict future price movements. It utilizes various charts, indicators, and tools to analyze market trends and investor behavior, providing insights into potential trading opportunities.

Chart Patterns and Price Predictions

Technical analysts study various chart patterns, such as head and shoulders, double tops/bottoms, and triangles, to anticipate potential price reversals or continuations. These patterns, formed by price movements over time, are believed to offer clues about future price direction.

Trading Volume Significance

Trading volume provides context to price movements. High volume accompanying a price increase suggests strong buying pressure, confirming the upward trend. Conversely, high volume during a price decline indicates strong selling pressure, potentially signaling a bearish trend. Low volume can indicate indecision or a lack of conviction in the market.

Moving Averages and Trend Identification

Moving averages, calculated by averaging prices over a specific period, are used to smooth out price fluctuations and identify trends. A common approach is to use multiple moving averages (e.g., 50-day and 200-day) to identify potential buy or sell signals based on their intersections.

Key Technical Indicators: RSI and MACD

The Relative Strength Index (RSI) measures the magnitude of recent price changes to evaluate overbought or oversold conditions. The Moving Average Convergence Divergence (MACD) identifies momentum changes by comparing two moving averages. These indicators help analysts assess potential turning points in price trends.

Hypothetical Stock Price Movement Chart, How a stock price is determined

Imagine a chart depicting a hypothetical stock’s price over six months. The price starts at $50, rises to $60 over two months, then dips to $55 before recovering to $65. The 50-day moving average consistently trails the price, while the 200-day moving average acts as support. The RSI reaches 70 (overbought) at the peak of $60, then falls below 30 (oversold) during the dip to $55.

The MACD shows a positive divergence during the initial rise, then a negative divergence before the recovery.

A stock’s price is fundamentally driven by the forces of supply and demand, reflecting investor sentiment and the company’s perceived value. Understanding this dynamic is key to analyzing any stock, including the fluctuations you might observe when checking the guardant stock price. Ultimately, though, the interplay of buying and selling pressure, alongside broader market conditions, determines the final price.

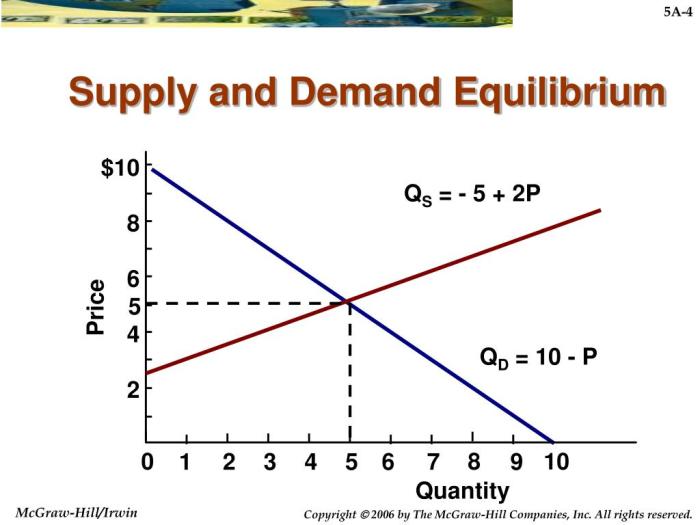

Supply and Demand Dynamics

The fundamental principle governing stock prices is the interaction of supply and demand. The price of a stock is ultimately determined by the balance between the number of shares buyers are willing to purchase at a given price and the number of shares sellers are willing to offer.

Institutional Trades and Price Fluctuations

Large institutional investors (e.g., mutual funds, hedge funds) can significantly influence stock prices. Their substantial trades can create sudden price swings, either upward or downward, depending on whether they are buying or selling.

Short Selling and Supply/Demand

Short selling involves borrowing and selling shares, hoping to buy them back later at a lower price. This practice increases the supply of shares available in the market, potentially putting downward pressure on prices. However, short selling can also trigger short squeezes, where a rapid price increase forces short sellers to buy back shares, further fueling the price rise.

Trading Volume and Price Discovery

High trading volume generally facilitates more efficient price discovery, as more buyers and sellers interact, leading to a more accurate reflection of the underlying value. Low volume can result in price distortions, as a relatively small number of trades can significantly impact the price.

Factors Influencing Supply and Demand

- Internal Factors: Company earnings, revenue growth, debt levels, management changes, product launches.

- External Factors: Economic growth, interest rates, inflation, geopolitical events, industry trends, regulatory changes.

Market Sentiment and News

Market sentiment and news events play a crucial role in shaping stock prices. Investor psychology, speculation, and the flow of information can lead to significant price fluctuations, both in the short term and long term.

News Events and Stock Price Impact

Positive news, such as strong earnings reports, new product launches, or strategic partnerships, generally leads to increased investor demand and higher stock prices. Conversely, negative news, like disappointing earnings, lawsuits, or regulatory setbacks, often results in lower prices.

Overall Market Trends and Individual Stocks

Source: stratzy.in

Individual stock prices are influenced by broader market trends. During bull markets (periods of rising prices), many stocks tend to rise, while during bear markets (periods of falling prices), many stocks decline. However, individual stocks can outperform or underperform the overall market based on their specific circumstances.

Investor Psychology and Speculation

Investor psychology and speculation can significantly impact stock price volatility. Fear, greed, and herd mentality can drive prices away from their fundamental values, leading to bubbles or crashes. Speculative trading, often based on short-term predictions rather than long-term fundamentals, can exacerbate price swings.

Positive vs. Negative News: Short-Term and Long-Term Effects

Positive news can lead to immediate price increases, but the long-term impact depends on the sustainability of the positive factors. Negative news often causes immediate price drops, but the long-term effect depends on the severity and the company’s ability to address the issues. For example, a one-time event like a natural disaster might have a short-term impact but not significantly affect long-term value if the company recovers quickly.

Varying Impacts of Different News Types

Different types of news have varying impacts. Earnings reports have a significant short-term impact, while regulatory changes can have both short-term and long-term consequences. A new product launch might initially boost the stock price, but its long-term impact depends on market acceptance and sales.

Macroeconomic Factors

Macroeconomic factors, such as interest rates, inflation, and economic growth, significantly influence stock market performance and individual stock valuations. These broad economic conditions create a backdrop against which company-specific factors play out.

Interest Rate Changes and Stock Valuations

Interest rate increases typically lead to lower stock valuations, as higher borrowing costs reduce corporate profitability and increase the attractiveness of bonds (fixed-income securities). Conversely, interest rate cuts can stimulate economic activity and boost stock prices.

Inflation’s Influence on Stock Prices

High inflation erodes purchasing power and increases uncertainty, often negatively impacting stock prices. Companies may struggle to maintain profit margins in inflationary environments, leading to lower earnings and reduced investor confidence.

Economic Growth/Recession and Stock Market

Economic growth typically correlates with rising stock prices, as companies benefit from increased consumer spending and investment. Recessions, on the other hand, often lead to stock market declines as corporate profits fall and investor sentiment deteriorates. The 2008 financial crisis is a prime example of a severe recession’s devastating impact on stock markets worldwide.

Macroeconomic Policies and Stock Market Performance

Government macroeconomic policies, such as monetary and fiscal policies, significantly influence stock market performance. Expansionary policies (e.g., lower interest rates, increased government spending) generally support economic growth and stock prices, while contractionary policies (e.g., higher interest rates, reduced government spending) can curb inflation but potentially slow economic growth and negatively impact stock prices.

Macroeconomic Factors and Their Impact

- Interest Rates: Higher rates generally lead to lower stock prices; lower rates often boost stock prices.

- Inflation: High inflation can erode corporate profits and negatively impact stock prices.

- Economic Growth: Strong economic growth usually supports rising stock prices; recessions often cause declines.

- Government Spending: Increased government spending can stimulate economic growth and boost stock prices.

- Geopolitical Events: Global events like wars or trade disputes can create uncertainty and impact stock markets.

FAQ Explained

What is the impact of a company’s dividend policy on its stock price?

A consistent dividend policy can attract income-seeking investors, potentially boosting demand and stock price. Conversely, unexpected dividend cuts can negatively impact investor sentiment and lead to price declines.

How do government regulations affect stock prices?

New regulations can create uncertainty and volatility. Positive regulations that benefit the company or industry can lead to price increases, while negative regulations can cause price drops.

What role does short-term speculation play in stock price movements?

Short-term speculation can lead to significant price volatility, often unrelated to a company’s underlying value. This can create both opportunities and risks for investors.

How do geopolitical events influence stock prices?

Geopolitical events, such as wars or trade disputes, can significantly impact investor confidence and lead to broad market fluctuations, affecting individual stock prices.