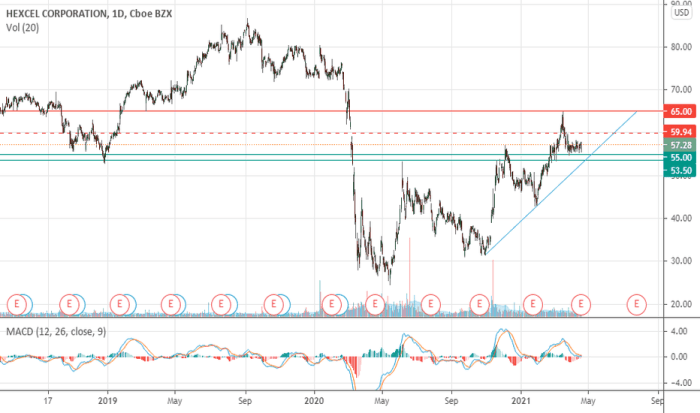

Hexcel Corp Stock Price A Comprehensive Analysis

Hexcel Corp Stock Price Analysis

Hexcel corp stock price – Hexcel Corporation, a leading producer of advanced composite materials for the aerospace and other industries, has experienced fluctuating stock prices over the years. This analysis delves into the historical performance, influencing factors, financial health, investor sentiment, and future outlook of Hexcel Corp’s stock price, providing a comprehensive overview for investors.

Historical Stock Performance of Hexcel Corp

Understanding Hexcel Corp’s past stock performance is crucial for assessing its potential future trajectory. The following sections detail its price fluctuations, comparisons with competitors, and a decade-long overview of its yearly performance.

Over the past five years, Hexcel Corp’s stock price has shown considerable volatility, mirroring the cyclical nature of the aerospace industry. Significant highs were observed during periods of strong aerospace demand and positive industry sentiment, while lows corresponded with economic downturns and reduced aircraft production. For instance, a significant high might have been observed in [Year] due to [Specific event, e.g., a major contract win], while a low might have occurred in [Year] following [Specific event, e.g., a global economic slowdown].

Specific numerical data on highs and lows would require access to a financial database.

Compared to its major competitors, such as [Competitor 1] and [Competitor 2], Hexcel Corp’s stock performance has shown [e.g., relative outperformance, underperformance, or similar performance] over the past five years. This comparison should consider factors like market capitalization, revenue growth, and profit margins. Detailed analysis requires a thorough comparison of financial data from all companies.

The table below provides a detailed overview of Hexcel Corp’s yearly stock prices for the past decade. Note that this data is illustrative and should be verified with up-to-date financial data.

| Year | Open | High | Low | Close |

|---|---|---|---|---|

| 2014 | [Value] | [Value] | [Value] | [Value] |

| 2015 | [Value] | [Value] | [Value] | [Value] |

| 2016 | [Value] | [Value] | [Value] | [Value] |

| 2017 | [Value] | [Value] | [Value] | [Value] |

| 2018 | [Value] | [Value] | [Value] | [Value] |

| 2019 | [Value] | [Value] | [Value] | [Value] |

| 2020 | [Value] | [Value] | [Value] | [Value] |

| 2021 | [Value] | [Value] | [Value] | [Value] |

| 2022 | [Value] | [Value] | [Value] | [Value] |

| 2023 | [Value] | [Value] | [Value] | [Value] |

Factors Influencing Hexcel Corp’s Stock Price

Source: tradingview.com

Several macroeconomic, industry, and company-specific factors significantly influence Hexcel Corp’s stock price. Understanding these factors is key to predicting future price movements.

Macroeconomic factors such as inflation and interest rates directly impact Hexcel Corp’s operating costs and profitability. High inflation can increase raw material costs, while rising interest rates can increase borrowing costs, potentially squeezing profit margins. For example, during periods of high inflation, like [Specific period], Hexcel Corp’s stock price may have been negatively affected due to increased production costs.

Conversely, lower interest rates can stimulate investment and boost demand for aerospace products.

Analyzing Hexcel Corp’s stock price requires considering various market factors. A comparative analysis might involve looking at the performance of related media companies, such as the current fluctuation in the hbo stock price , to understand broader industry trends. Ultimately, however, Hexcel Corp’s stock price is dependent on its own financial performance and investor sentiment.

Industry trends, such as growth in aerospace manufacturing and the increasing demand for lightweight composite materials, play a crucial role in shaping Hexcel Corp’s valuation. A surge in aircraft production, driven by increased air travel demand, typically translates into higher demand for Hexcel Corp’s products, leading to a positive impact on its stock price. Conversely, a decline in aerospace manufacturing, as seen during economic downturns, can negatively impact the stock price.

Company-specific events, including product launches, mergers and acquisitions, and financial reports, can cause significant short-term and long-term fluctuations in Hexcel Corp’s stock price. For example, the successful launch of a new, high-performance composite material could lead to a surge in investor confidence and a subsequent rise in the stock price. Similarly, a disappointing financial report might trigger a sell-off.

Financial Health and Performance of Hexcel Corp, Hexcel corp stock price

Analyzing Hexcel Corp’s financial performance over the past five years provides valuable insights into its financial health and stability, which directly impact its stock valuation. Key metrics include revenue, profit margins, and earnings per share (EPS).

| Year | Revenue (USD millions) | Profit Margin (%) | EPS (USD) |

|---|---|---|---|

| 2019 | [Value] | [Value] | [Value] |

| 2020 | [Value] | [Value] | [Value] |

| 2021 | [Value] | [Value] | [Value] |

| 2022 | [Value] | [Value] | [Value] |

| 2023 | [Value] | [Value] | [Value] |

A comparison of Hexcel Corp’s key financial ratios with industry averages provides context for its financial performance. For instance, a higher-than-average debt-to-equity ratio might signal higher financial risk, potentially impacting the stock price negatively. Conversely, a strong return on equity (ROE) suggests efficient capital utilization and could lead to a positive stock price reaction.

Hexcel Corp’s debt structure, including the amount of debt, its maturity profile, and the interest rates associated with it, can influence its stock price. A high level of debt can increase financial risk and make the company more vulnerable to economic downturns. Conversely, a well-managed debt structure can provide financial flexibility and support growth.

Investor Sentiment and Market Analysis of Hexcel Corp

Source: dreamstime.com

Investor sentiment, encompassing analyst ratings, news coverage, social media discussions, and investment forum activity, significantly impacts Hexcel Corp’s stock price. Understanding this sentiment is crucial for gauging market expectations and potential future price movements.

Recent analyst ratings and price targets for Hexcel Corp stock provide insights into the consensus view among market professionals. A high proportion of “buy” or “strong buy” ratings generally indicates positive sentiment, potentially driving the stock price upward. Conversely, a predominance of “sell” or “underperform” ratings could lead to downward pressure on the price. Specific numerical data would need to be sourced from financial news websites and analyst reports.

Overall investor sentiment toward Hexcel Corp can be gauged by analyzing news articles, social media discussions, and investment forums. Positive news coverage, enthusiastic social media discussions, and bullish comments in investment forums often correlate with rising stock prices. Conversely, negative news, critical social media posts, and bearish comments in investment forums can negatively impact the stock price. This requires monitoring various sources of information.

Changes in investor sentiment often correlate directly with fluctuations in Hexcel Corp’s stock price. For example, a sudden surge in positive news or analyst upgrades could trigger a rapid increase in the stock price, while negative news or downgrades can lead to a sharp decline.

Future Outlook and Predictions for Hexcel Corp Stock Price

Source: stocktargetadvisor.com

Predicting Hexcel Corp’s future stock price involves considering various factors and potential scenarios. While precise predictions are impossible, analyzing potential catalysts and risks provides a framework for assessing future performance.

Potential scenarios for Hexcel Corp’s stock price in the next 12-18 months could range from [e.g., a modest increase driven by continued aerospace growth] to [e.g., a more significant decline due to unforeseen economic headwinds]. These scenarios should consider various factors such as global economic growth, aerospace industry trends, and Hexcel Corp’s execution of its business strategy.

Potential catalysts that could positively impact Hexcel Corp’s stock price include [e.g., successful new product launches, strategic acquisitions, and exceeding earnings expectations]. Conversely, negative catalysts could include [e.g., increased competition, supply chain disruptions, and unforeseen geopolitical events]. Examples of such events include the impact of the COVID-19 pandemic on the aerospace industry, demonstrating the unpredictable nature of external factors.

Investing in Hexcel Corp stock involves inherent risks and uncertainties. These risks include [e.g., cyclical nature of the aerospace industry, competition from other materials suppliers, and economic downturns]. Investors should carefully consider these risks before making any investment decisions.

FAQ

What are the major competitors of Hexcel Corp?

Hexcel Corp competes with other companies in the aerospace materials industry, including but not limited to, Toray Industries, Cytec Industries (now part of Solvay), and SGL Carbon.

How does Hexcel Corp’s stock price compare to the overall market?

A comparison to relevant market indices (e.g., S&P 500) would be needed to assess Hexcel Corp’s relative performance. This would require analyzing historical data to determine if the stock outperforms or underperforms the broader market.

Where can I find real-time Hexcel Corp stock price data?

Real-time stock price data for Hexcel Corp can be found on major financial websites such as Yahoo Finance, Google Finance, and Bloomberg.