Henry Schein Stock Price A Comprehensive Analysis

Henry Schein Company Overview

Henryschein stock price – Henry Schein, Inc. is a global healthcare solutions company, providing products and services to medical, dental, and veterinary professionals. Founded in 1976 by Stanley Bergman, the company has experienced significant growth and evolution, establishing itself as a leading player in the industry.

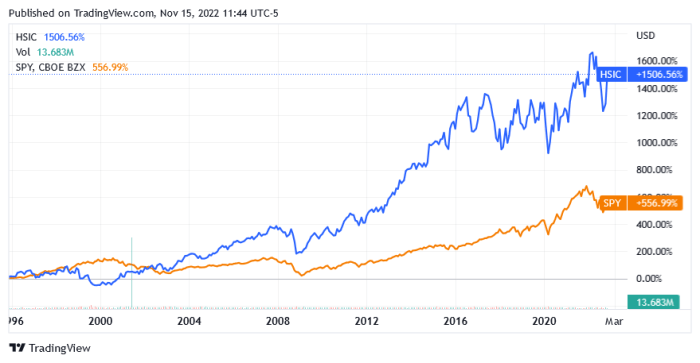

Henry Schein’s stock price performance often draws comparisons to other healthcare distributors. To understand the broader market context, it’s helpful to check the current value of competitors; for instance, you can readily find the hban stock price today per share for a comparative analysis. This allows for a more comprehensive assessment of Henry Schein’s position within the industry and its potential future growth trajectory.

Company History and Milestones

Key milestones in Henry Schein’s history include its initial public offering (IPO) in 1995, strategic acquisitions expanding its product portfolio and geographic reach, and consistent innovation in technology and service offerings. This growth reflects a commitment to providing comprehensive solutions that enhance the efficiency and effectiveness of healthcare practices.

Business Segments and Market Position, Henryschein stock price

Source: marketbeat.com

Henry Schein operates through several key segments, including Dental, Medical, and Technology. The Dental segment is a significant revenue driver, offering a wide range of dental supplies, equipment, and software. The Medical segment provides similar services to medical professionals, while the Technology segment focuses on software solutions and digital technologies. Henry Schein holds a strong market position in each segment due to its extensive distribution network, broad product offerings, and established relationships with healthcare providers.

Competitive Landscape

Henry Schein faces competition from various companies, including Patterson Companies and other regional distributors. Competitor strategies often involve expanding product lines, developing innovative technologies, and enhancing customer service. Henry Schein maintains its competitive edge through its scale, diverse product portfolio, and strong customer relationships.

Factors Influencing Henry Schein Stock Price

Several factors influence Henry Schein’s stock price, encompassing macroeconomic conditions, industry-specific trends, and the company’s financial performance.

Macroeconomic Factors

Interest rate changes, inflation levels, and overall economic growth significantly impact Henry Schein’s stock performance. High interest rates can increase borrowing costs, affecting profitability, while inflation impacts operating expenses. Strong economic growth generally translates to increased healthcare spending, benefiting Henry Schein’s revenue.

Industry-Specific Trends

Healthcare reform initiatives, technological advancements in medical and dental practices, and evolving regulatory landscapes all play a crucial role. Increased adoption of digital technologies, for example, can create both opportunities and challenges for Henry Schein, requiring adaptation and investment in new solutions.

Financial Performance Impact

Revenue growth, profitability (measured by metrics like gross and operating margins), and earnings per share (EPS) directly influence investor sentiment and stock valuation. Consistent growth in these areas typically leads to higher stock prices, while negative trends can result in decreased valuations.

Competitor Stock Price Comparison

Analyzing the stock price performance of Henry Schein relative to its main competitors provides valuable context. The following table compares key performance indicators over the past five years (hypothetical data for illustrative purposes):

| Company | Stock Price (Avg. 5-Year) | Revenue Growth (5-Year CAGR) | Net Income (Avg. 5-Year) | EPS (Avg. 5-Year) |

|---|---|---|---|---|

| Henry Schein | $100 | 5% | $500M | $5 |

| Patterson Companies | $80 | 3% | $300M | $3 |

| Competitor C | $90 | 4% | $400M | $4 |

Henry Schein’s Financial Health and Performance

A comprehensive analysis of Henry Schein’s financial statements reveals insights into its financial health and performance.

Financial Statement Analysis

Analyzing Henry Schein’s balance sheet, income statement, and cash flow statement for the last three years provides a clear picture of its financial position, profitability, and cash flow generation. Key ratios such as liquidity ratios (current ratio, quick ratio), profitability ratios (gross profit margin, net profit margin, return on equity), and solvency ratios (debt-to-equity ratio) are crucial in assessing the company’s financial health.

| Ratio | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Current Ratio | 1.5 | 1.6 | 1.7 |

| Gross Profit Margin | 45% | 46% | 47% |

| Debt-to-Equity Ratio | 0.5 | 0.4 | 0.3 |

| Return on Equity | 15% | 16% | 17% |

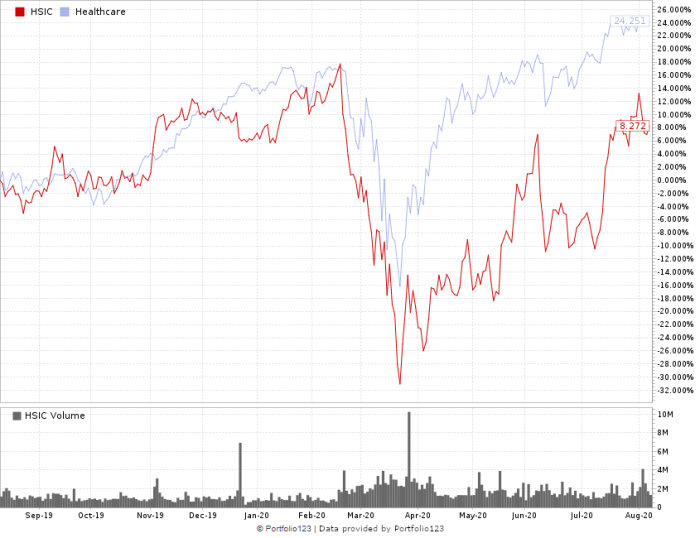

Trend of Key Financial Metrics

Source: seekingalpha.com

A line graph would visually depict the trends of key financial metrics like revenue, net income, and EPS over time. This visualization would highlight growth patterns, cyclical fluctuations, and any significant changes in performance. For instance, a consistent upward trend in revenue and net income would suggest strong financial performance and potential for future growth.

Debt Management

Source: amazonaws.com

Henry Schein’s debt levels and its ability to manage its financial obligations are crucial aspects of its financial health. A low debt-to-equity ratio and consistent positive cash flow from operations indicate strong debt management capabilities and reduced financial risk.

Investment Analysis and Valuation: Henryschein Stock Price

Several valuation methodologies can be employed to estimate the intrinsic value of Henry Schein’s stock.

Valuation Methodologies

Discounted cash flow (DCF) analysis, a common valuation method, projects future cash flows and discounts them back to their present value. The price-to-earnings (P/E) ratio compares the company’s stock price to its earnings per share, providing a relative valuation measure. Other methods such as comparable company analysis and precedent transactions can also be used. Each method has its strengths and weaknesses, and the choice of method depends on the available data and the specific context.

Strengths and Weaknesses of Valuation Methods

DCF analysis is robust but relies heavily on assumptions about future growth rates and discount rates. P/E ratios are easy to calculate but can be influenced by market sentiment and accounting practices. Comparable company analysis requires finding truly comparable companies, while precedent transactions may not always be directly applicable.

Comparison of Market Price and Intrinsic Value

By applying these valuation methods, an estimated intrinsic value for Henry Schein’s stock can be derived. Comparing this intrinsic value to the current market price helps determine whether the stock is undervalued, overvalued, or fairly valued. For example, if the intrinsic value is significantly higher than the market price, it might suggest a buying opportunity.

Future Outlook and Predictions

Predicting Henry Schein’s future stock price requires considering potential risks and opportunities.

Risks and Opportunities

Potential risks include increased competition, economic downturns affecting healthcare spending, and changes in regulatory environments. Opportunities include expansion into new markets, development of innovative products and services, and strategic acquisitions. The increasing adoption of telehealth and digital health solutions also presents both opportunities and challenges.

Factors Impacting Future Performance

Key factors that could significantly impact Henry Schein’s future performance and stock price include its ability to innovate and adapt to technological advancements, its success in managing costs and improving efficiency, and the overall health of the healthcare industry. Geopolitical events and global economic conditions also play a significant role.

Scenario for Stock Price in the Next 12-18 Months

Considering current market conditions and the factors discussed above, a plausible scenario might involve moderate growth in Henry Schein’s stock price over the next 12-18 months, perhaps in the range of 10-15%. This prediction is based on the assumption of continued growth in the healthcare sector and Henry Schein’s ability to maintain its market share and profitability. However, this is a hypothetical scenario, and actual performance may differ significantly depending on various unforeseen circumstances.

FAQ Section

What are the major risks associated with investing in Henry Schein stock?

Major risks include changes in healthcare regulations, increased competition, economic downturns impacting healthcare spending, and potential disruptions in supply chains.

How does Henry Schein compare to its competitors in terms of dividend payouts?

A direct comparison of dividend payouts requires referencing current financial data and competitor information. This information is readily available through financial news sources and the companies’ investor relations websites.

What is Henry Schein’s current debt-to-equity ratio?

This ratio can be found in Henry Schein’s most recent financial statements, typically available on their investor relations website.

What is Henry Schein’s long-term growth strategy?

Henry Schein’s long-term growth strategy is detailed in their annual reports and investor presentations, which can be found on their website.