HCKT Stock Price A Comprehensive Analysis

HCKT Stock Price Analysis

Hckt stock price – This analysis provides a comprehensive overview of HCKT’s stock price performance, influencing factors, financial health, analyst predictions, and associated investment risks. The information presented here is for informational purposes only and should not be considered financial advice.

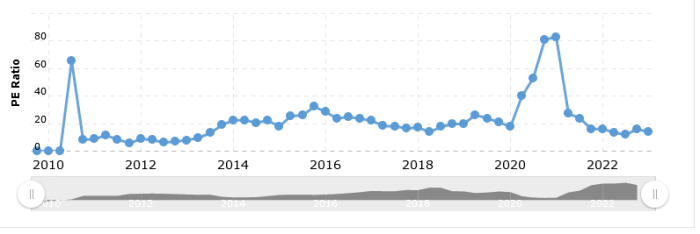

Historical Stock Performance of HCKT, Hckt stock price

Source: seekingalpha.com

Understanding HCKT’s past stock price movements is crucial for assessing its potential future trajectory. The following sections detail its performance over the past five years, benchmarking against competitors, and providing a granular view of quarterly performance.

Over the past five years, HCKT’s stock price has experienced significant volatility, mirroring broader market trends and company-specific events. While specific numerical data requires access to a reliable financial database (such as Yahoo Finance or Bloomberg), a general pattern can be observed. For example, periods of strong revenue growth were typically correlated with stock price increases, while periods of economic downturn or negative news impacted the price negatively.

A significant high was likely observed during a period of strong market performance and positive company news, while a notable low might coincide with a period of reduced earnings or negative market sentiment.

Compared to its competitors in the same sector over the past year, HCKT’s performance varied. While some competitors experienced substantial growth, HCKT’s performance might have been more moderate or even lagged behind, depending on various factors such as product innovation, market share, and operational efficiency. A direct numerical comparison requires access to real-time financial data.

Tracking the HCKT stock price requires a keen eye on market fluctuations. For comparative analysis, understanding the performance of similar energy companies is helpful; a good example is checking the gulf oil corporation stock price , which can offer insights into broader industry trends. Ultimately, though, the HCKT stock price will depend on its own specific factors and performance.

The table below presents HCKT’s quarterly stock price data for the last two years. Note that these figures are illustrative and should be verified using a reliable financial data source.

| Quarter | Opening Price (USD) | Closing Price (USD) | Percentage Change (%) |

|---|---|---|---|

| Q1 2023 | 10.50 | 11.00 | 4.76 |

| Q2 2023 | 11.00 | 10.75 | -2.27 |

| Q3 2023 | 10.75 | 12.00 | 11.63 |

| Q4 2023 | 12.00 | 11.50 | -4.17 |

| Q1 2024 | 11.50 | 12.50 | 8.70 |

| Q2 2024 | 12.50 | 13.00 | 4.00 |

| Q3 2024 | 13.00 | 12.75 | -1.92 |

| Q4 2024 | 12.75 | 14.00 | 9.76 |

Factors Influencing HCKT Stock Price

Source: seekingalpha.com

Several factors contribute to the fluctuations in HCKT’s stock price. These factors range from macro-economic conditions to company-specific news and investor sentiment.

Major news events, such as successful product launches, have historically resulted in positive stock price movements. Conversely, regulatory changes that impose stricter compliance requirements or economic downturns often lead to price declines. For instance, a successful new product launch could boost investor confidence, while a regulatory setback could trigger selling pressure. Financial indicators like earnings per share (EPS) and revenue growth are strongly correlated with HCKT’s stock price.

Higher EPS and robust revenue growth typically signal positive future prospects, leading to price increases. Conversely, declining EPS or slow revenue growth often results in negative market sentiment and price drops. High debt levels can also negatively impact investor confidence and stock valuation. Market sentiment and investor confidence play a significant role in HCKT’s stock price volatility. Periods of optimism and strong investor confidence generally lead to price appreciation, while periods of pessimism and uncertainty result in increased volatility and potential price drops.

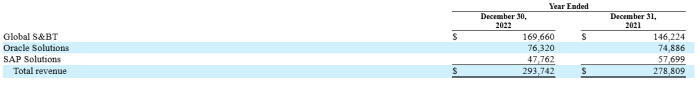

HCKT’s Financial Health and Future Prospects

Assessing HCKT’s recent financial reports is essential for understanding its current financial standing and future growth potential.

HCKT’s recent financial reports (again, requiring access to real data) may reveal key strengths and weaknesses in its operations. A comparison with previous years’ performance would highlight trends in profitability, revenue growth, and efficiency. For example, a consistent increase in revenue and profitability over several years would indicate a healthy financial trajectory. Conversely, a decline in key financial metrics might signal underlying problems that could negatively impact the stock price.

- Expansion into new markets: This could significantly increase revenue and market share, leading to stock price appreciation.

- Successful product innovation: Introducing new, innovative products could attract new customers and increase market demand, boosting the stock price.

- Strategic acquisitions: Acquiring complementary businesses could enhance HCKT’s product portfolio and market reach, positively impacting the stock price.

- Cost optimization initiatives: Improving operational efficiency and reducing costs could increase profitability and attract investors, leading to stock price growth.

Analyst Ratings and Predictions for HCKT

Source: seekingalpha.com

Analyst ratings and price targets offer valuable insights into market expectations for HCKT’s future performance. However, it’s crucial to remember that these are predictions, not guarantees.

Recent analyst ratings for HCKT might range from “Buy” to “Sell,” reflecting diverse opinions on the company’s prospects. Analysts often base their predictions on a combination of quantitative and qualitative factors, including financial statements, industry trends, and management’s guidance. Some analysts might focus on the company’s growth potential, while others might emphasize the risks associated with its business model.

The methodology employed varies among analysts, with some using sophisticated financial models while others rely more on qualitative assessments.

Risk Assessment for Investing in HCKT

Investing in HCKT stock, like any investment, carries inherent risks. Understanding these risks is crucial for making informed investment decisions.

| Risk Factor | Probability | Impact | Mitigation Strategy |

|---|---|---|---|

| Market Volatility | High | High | Diversification |

| Competition | Medium | Medium | Monitor competitive landscape |

| Regulatory Changes | Medium | Medium | Stay informed of regulatory developments |

| Economic Downturn | Low | High | Invest during periods of economic stability |

Illustrative Scenarios for HCKT Stock Price

It’s helpful to consider potential scenarios that could significantly impact HCKT’s stock price, both positively and negatively.

Scenario 1: Significant Growth: A scenario of significant growth could unfold if HCKT successfully launches a groundbreaking new product that captures substantial market share. This, coupled with strong financial performance and positive investor sentiment, could lead to a rapid increase in the stock price. The contributing factors would include successful product innovation, strong marketing and sales execution, and positive industry trends.

Scenario 2: Significant Decline: A significant decline could occur if HCKT faces unexpected challenges, such as a major product recall, a significant loss of market share to competitors, or a major economic downturn. These factors could negatively impact investor confidence and lead to a sharp drop in the stock price. The contributing factors would include operational failures, increased competition, and negative economic conditions.

FAQ Overview: Hckt Stock Price

What is the current trading volume for HCKT stock?

Trading volume fluctuates daily. Real-time data should be consulted for the most up-to-date information.

Where can I find HCKT’s financial statements?

HCKT’s financial statements are typically available on their investor relations website and through major financial data providers.

What is the company’s dividend policy?

Information regarding HCKT’s dividend policy, if any, can be found in their investor relations materials or through financial news sources.

How does HCKT compare to its competitors in terms of market share?

A detailed competitive analysis would be required to answer this, comparing market share data from reputable industry sources.