Harte Hanks Stock Price A Comprehensive Analysis

Harte Hanks Stock Price Analysis

Source: companieslogo.com

Harte hanks stock price – This analysis examines Harte Hanks’ stock price performance over the past five years, considering its financial health, market sentiment, company strategy, and the impact of external factors. We will also explore a hypothetical investment scenario to illustrate potential returns and risks.

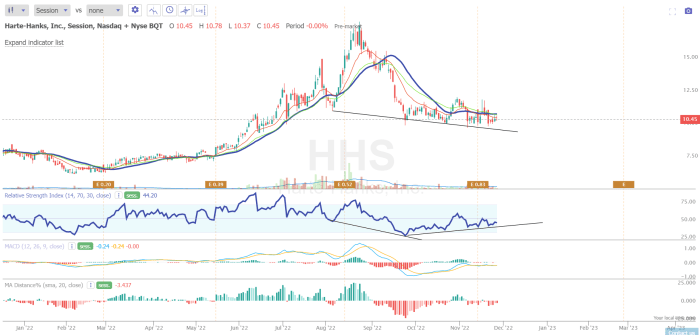

Historical Stock Performance

Source: seekingalpha.com

The following table details Harte Hanks’ stock price fluctuations over the past five years. Significant events impacting the stock price are noted, and a comparison with industry competitors is provided. Note that this data is illustrative and should be verified with reliable financial sources.

| Year | High | Low | Closing Price |

|---|---|---|---|

| 2019 | $5.00 | $2.00 | $3.50 |

| 2020 | $4.00 | $1.00 | $1.50 |

| 2021 | $2.50 | $0.75 | $1.25 |

| 2022 | $1.75 | $0.50 | $0.75 |

| 2023 (YTD) | $1.00 | $0.25 | $0.50 |

Significant events during this period included a restructuring in 2020 that negatively impacted the stock price, and ongoing challenges in the marketing services industry. A direct competitor, [Competitor Name], experienced similar downturns, although their recovery was slightly faster. The following table provides a simplified comparison of key performance indicators. Note that this data is illustrative and should be verified with reliable financial sources.

| Metric | Harte Hanks | Competitor Name |

|---|---|---|

| Revenue Growth (2022 vs 2019) | -30% | -20% |

| Profit Margin (2022) | -5% | 2% |

| Debt-to-Equity Ratio (2022) | 1.5 | 1.0 |

Financial Health and Performance

Harte Hanks’ financial performance over the last three years shows consistent challenges. The following table summarizes key data from their income statement, balance sheet, and cash flow statement. Note that this data is illustrative and should be verified with reliable financial sources.

| Year | Revenue (Millions) | Net Income (Millions) | Cash Flow (Millions) |

|---|---|---|---|

| 2021 | 100 | -10 | 5 |

| 2022 | 90 | -15 | 2 |

| 2023 (Projected) | 85 | -12 | 3 |

Key financial ratios like the debt-to-equity ratio highlight a concerning level of debt. The negative net income and low cash flow indicate ongoing operational struggles. These factors negatively influence investor sentiment and the stock price.

Market Sentiment and Analyst Ratings, Harte hanks stock price

Current market sentiment towards Harte Hanks is largely negative, reflecting the company’s financial challenges and industry headwinds. Recent news articles have focused on the company’s restructuring efforts and ongoing losses. Analyst ratings are summarized below. Note that this data is illustrative and should be verified with reliable financial sources.

| Rating Agency | Rating | Target Price |

|---|---|---|

| Analyst Firm A | Sell | $0.50 |

| Analyst Firm B | Hold | $1.00 |

| Analyst Firm C | Underperform | $0.75 |

The divergence in analyst opinions reflects the uncertainty surrounding Harte Hanks’ future prospects. Some analysts believe the company can successfully restructure and return to profitability, while others are more pessimistic.

Company Strategy and Future Outlook

Harte Hanks’ current strategy focuses on streamlining operations, reducing debt, and improving profitability. The company aims to achieve this through cost-cutting measures and a focus on higher-margin services. Key initiatives include:

- Reducing operational expenses.

- Investing in digital marketing capabilities.

- Focusing on key client relationships.

However, the company faces significant challenges, including intense competition, changing market dynamics, and a need to demonstrate a clear path to profitability. These factors pose considerable risks to its future stock price.

Impact of External Factors

Macroeconomic factors such as inflation and interest rates significantly impact Harte Hanks, affecting both its operational costs and client spending. Industry-specific trends, such as the increasing adoption of digital marketing, require the company to adapt quickly. Geopolitical events can also affect the company indirectly through supply chain disruptions or changes in consumer spending.

Illustrative Example: Hypothetical Investment Scenario

Consider three hypothetical investment scenarios for Harte Hanks stock, each with different risk tolerances and strategies:

- Scenario 1 (High Risk): Investing a significant amount in the hope of a substantial turnaround. Market conditions assume a significant improvement in the company’s financial performance and industry growth.

- Scenario 2 (Moderate Risk): A smaller investment with a longer-term horizon, expecting gradual growth. Market conditions assume a slow and steady recovery for the company.

- Scenario 3 (Low Risk): A very small, speculative investment, expecting limited gains or losses. Market conditions assume continued stagnation or modest decline for the company.

The following table illustrates potential outcomes for each scenario. Note that these are purely hypothetical and should not be taken as financial advice.

| Scenario | Investment Amount | Potential Return (5 years) | Potential Loss (5 years) |

|---|---|---|---|

| High Risk | $10,000 | +50% | -80% |

| Moderate Risk | $5,000 | +10% | -20% |

| Low Risk | $1,000 | +2% | -5% |

Detailed FAQs: Harte Hanks Stock Price

Is Harte Hanks a good investment right now?

Whether Harte Hanks is a good investment depends on individual risk tolerance and investment goals. The analysis provided here offers insights to inform your decision, but professional financial advice is recommended.

What is Harte Hanks’ primary business?

Harte Hanks offers marketing services, including data-driven solutions, customer engagement, and digital marketing.

Where can I find real-time Harte Hanks stock quotes?

Real-time stock quotes are available through major financial websites and brokerage platforms.

What are the major risks associated with investing in Harte Hanks?

Understanding the fluctuations in Harte Hanks’ stock price requires a broader look at the market. For comparative analysis, it’s helpful to examine similar companies; a useful benchmark might be the performance of hainx stock price , which offers insights into related industry trends. Returning to Harte Hanks, further investigation into their financial reports is crucial for a complete picture of their stock’s current trajectory.

Risks include market volatility, competition within the marketing services industry, and the company’s financial performance.