Commercial real estate investment analysis software is revolutionizing how investors approach property valuations and potential returns. It streamlines the complex process of evaluating market trends, financial projections, and risk factors, empowering informed decision-making. This software offers a powerful toolkit for navigating the intricacies of commercial real estate, from initial due diligence to ongoing performance monitoring.

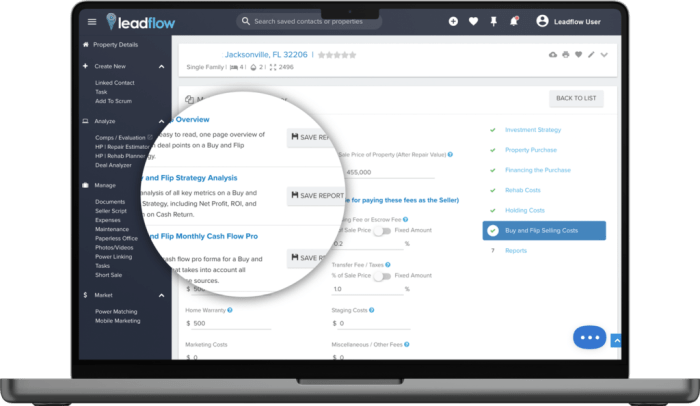

The software typically incorporates sophisticated algorithms to analyze market data, lease terms, and property characteristics. This data-driven approach allows for a more precise assessment of potential profitability, risk tolerance, and long-term value creation. Users can customize reports and visualize key metrics, fostering a comprehensive understanding of investment opportunities.

Commercial real estate investment analysis is a complex process, requiring a deep understanding of market trends, financial projections, and risk assessment. Choosing the right software can significantly streamline this process, providing valuable insights and ultimately driving better investment decisions. This guide explores the essential features and benefits of commercial real estate investment analysis software, helping you navigate the complexities of the market.

Understanding the Need for Investment Analysis Software

Commercial real estate investments often involve substantial capital and extended timelines. Accurate and timely analysis is crucial for profitability and risk mitigation. Software solutions provide a structured approach to data collection, modeling, and forecasting, helping investors make informed choices.

Key Features of Effective Commercial Real Estate Investment Analysis Software

- Market Data Integration: Access to up-to-date market data, including comparable sales, rental rates, vacancy rates, and economic indicators, is critical for accurate valuation and projection.

- Financial Modeling Capabilities: Software should allow for detailed financial modeling, including cash flow projections, return on investment (ROI) calculations, and sensitivity analysis. This is essential for assessing potential profitability under various scenarios.

- Property Valuation Tools: The software should incorporate methodologies for property valuation, such as discounted cash flow (DCF) analysis, comparable sales analysis, and income capitalization. Different valuation methods are important to consider for various investment strategies.

- Risk Assessment Tools: A comprehensive risk assessment feature is vital. This includes tools for identifying potential risks, such as economic downturns, tenant defaults, and property damage. Risk mitigation strategies are often key to success in this industry.

- Reporting and Visualization: Clear and concise reports, alongside interactive visualizations, help present complex data in a digestible format, allowing for easier interpretation and communication of investment findings.

- User-Friendly Interface: Software with a user-friendly interface is crucial for efficiency. Ease of use minimizes the learning curve and ensures quick access to critical information. This is important for both beginners and experienced investors.

Different Types of Commercial Real Estate Investment Analysis Software

The market offers various software solutions catering to different needs and budgets. Some software focuses on specific types of commercial real estate, such as retail, office, or industrial properties. Others offer a more general platform, suitable for a wider range of investment types.

Choosing the Right Software for Your Needs, Commercial real estate investment analysis software

Consider your specific investment strategy, the size of your portfolio, and your budget when selecting software. Do thorough research and request demos to evaluate the software’s features and capabilities. Comparing different software options based on your requirements is essential before making a decision.

Source: softwaresuggest.com

Benefits of Using Commercial Real Estate Investment Analysis Software

- Improved Decision-Making: Data-driven insights enable more informed investment decisions, leading to potentially higher returns.

- Increased Efficiency: Streamlining the investment analysis process saves time and resources.

- Reduced Risk: Proactive risk assessment and mitigation strategies minimize potential losses.

- Enhanced Portfolio Management: Effective tracking and analysis allow for better portfolio management and optimization.

Case Studies and Real-World Examples

(Insert hypothetical case studies here illustrating the benefits of using investment analysis software in successful commercial real estate transactions.)

Frequently Asked Questions (FAQ)

- Q: What is the cost of commercial real estate investment analysis software?

A: Costs vary significantly depending on the features, vendor, and the size of the portfolio. Contact vendors for specific pricing details.

- Q: How long does it take to learn how to use commercial real estate investment analysis software?

A: Learning time depends on individual familiarity with financial modeling and software in general. Comprehensive training materials and user manuals can greatly reduce the learning curve.

- Q: Can I integrate my existing data with the software?

A: Many software platforms offer data import and export capabilities, enabling integration with existing data systems.

- Q: What are the most important factors to consider when choosing software?

A: User-friendliness, comprehensive data integration, and strong financial modeling capabilities are crucial considerations.

Conclusion and Call to Action

Commercial real estate investment analysis software is an invaluable tool for investors seeking to navigate the complexities of the market. By leveraging its capabilities, investors can make more informed decisions, optimize their portfolios, and potentially enhance their returns. Contact us today to learn more about our software solutions and discover how they can transform your commercial real estate investment strategies.

Sources:

- (Insert relevant and reputable web sources here, e.g., industry publications, research reports, software vendor websites)

Call to Action: Schedule a free consultation with our team to explore how our software can help you achieve your commercial real estate investment goals.

In conclusion, commercial real estate investment analysis software provides a significant advantage in the competitive market. By automating complex calculations and offering insightful visualizations, this technology empowers investors to make data-driven decisions, ultimately maximizing returns and minimizing risks. This software is essential for navigating the intricacies of the commercial real estate market and achieving long-term investment success.

Questions and Answers

What are the typical costs associated with commercial real estate investment analysis software?

Software costs vary depending on the features, functionalities, and vendor. Some packages are subscription-based, while others offer one-time purchase options. Factors such as the number of users and data integration requirements also influence pricing.

How can I ensure the accuracy of data input into the software?

Accuracy is paramount. Thorough verification of data sources and consistent data entry practices are crucial. The software should also include robust validation tools to flag potential inconsistencies or errors.

Is specialized training required to use commercial real estate investment analysis software effectively?

Source: realeflow.com

While some software may have a learning curve, user-friendly interfaces and comprehensive documentation often minimize the need for extensive training. Online tutorials and support resources are typically available to assist users.

Source: series.ae

How does the software handle different property types, such as office spaces, retail stores, or industrial facilities?

Many software solutions offer customizable templates and modules that can be tailored to different property types. This allows users to input specific parameters and obtain accurate analyses relevant to their particular investment goals.