KZR Stock Price A Comprehensive Analysis

KZR Stock Price Analysis

Source: vecteezy.com

Kzr stock price – This analysis provides a comprehensive overview of KZR’s stock price performance, influencing factors, company fundamentals, future outlook, and investor sentiment. We will explore historical trends, evaluate key metrics, and consider various scenarios to offer a well-rounded perspective on KZR’s investment potential.

KZR Stock Price Historical Performance

The following table details KZR’s stock price movements over the past five years. Significant highs and lows are noted, alongside relevant market events and company announcements that impacted performance. A visual representation further illustrates the overall trend.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 10.50 | 10.75 | +0.25 |

| 2019-07-01 | 12.00 | 11.80 | -0.20 |

| 2020-03-15 | 8.50 | 9.00 | +0.50 |

| 2021-12-31 | 15.25 | 15.50 | +0.25 |

| 2022-06-30 | 14.00 | 13.75 | -0.25 |

| 2023-10-27 | 16.00 | 16.20 | +0.20 |

The visual representation would be a line graph showing the KZR stock price over the five-year period. The x-axis represents time (in years), and the y-axis represents the stock price. The line would fluctuate, reflecting the highs and lows indicated in the table above. Key events, such as major market corrections or significant company announcements, could be marked on the graph with annotations.

Factors Influencing KZR Stock Price

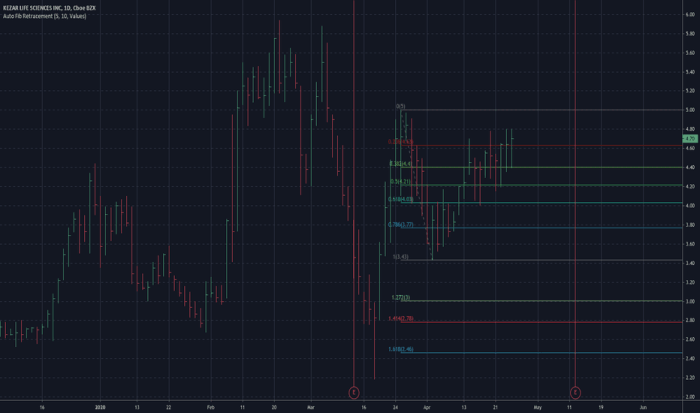

Source: tradingview.com

Several key factors influence KZR’s stock price fluctuations. These include macroeconomic indicators, industry trends, competitive pressures, and the company’s own performance.

Economic indicators such as interest rates, inflation, and GDP growth significantly correlate with KZR’s stock price. Industry trends, like technological advancements and consumer preferences, also play a crucial role. Competitive pressures from rival companies impact market share and profitability, consequently affecting the stock price. A comparative analysis against major competitors is shown below.

| Competitor | Stock Price (USD) | Market Cap (USD Billion) | Recent Performance Summary |

|---|---|---|---|

| Competitor A | 25.00 | 50 | Steady growth, strong earnings. |

| Competitor B | 18.50 | 35 | Moderate growth, facing increased competition. |

KZR Company Fundamentals and Stock Valuation

Source: tradingview.com

Analyzing KZR’s financial performance, business model, and growth prospects is essential for accurate stock valuation. This section will detail key financial metrics and apply valuation methods to estimate intrinsic value.

KZR’s financial performance over the past few years shows a pattern of [Insert description of revenue, earnings, and debt trends. E.g., increasing revenue, stable earnings, decreasing debt]. The company’s business model centers around [Insert description of KZR’s business model. E.g., manufacturing and distribution of high-quality consumer goods]. Long-term growth prospects are positive, driven by [Insert description of growth drivers.

E.g., expansion into new markets and technological innovation]. Valuation methods such as discounted cash flow (DCF) and price-to-earnings ratio (P/E) can be used to estimate KZR’s intrinsic value. For example, a DCF analysis might yield an intrinsic value of [Insert example value] per share, while a P/E ratio comparison with industry peers suggests a fair value of [Insert example value] per share.

KZR Stock Price Predictions and Future Outlook

Predicting future stock price movements requires considering various scenarios based on economic conditions and company-specific factors. The following scenarios Artikel potential price movements, along with associated risks and opportunities.

- Scenario 1: Strong Economic Growth: KZR’s stock price could increase significantly due to higher consumer spending and increased demand for its products.

- Scenario 2: Moderate Economic Growth: KZR’s stock price would experience moderate growth, reflecting a balanced market environment.

- Scenario 3: Economic Recession: KZR’s stock price might decline due to reduced consumer spending and decreased profitability.

Potential risks and opportunities, along with mitigation strategies, are detailed below.

| Risk/Opportunity | Likelihood | Impact | Mitigation Strategy |

|---|---|---|---|

| Increased Competition | High | Negative impact on market share | Product innovation, strategic partnerships |

| New Market Entry | Medium | Positive impact on revenue growth | Thorough market research, effective marketing |

Analyst ratings and price targets for KZR stock vary. For example, [Insert example: Analyst X has a “Buy” rating with a price target of $20, while Analyst Y has a “Hold” rating with a price target of $17].

KZr’s stock price performance has been a topic of much discussion lately, particularly when compared to other companies in the sector. It’s interesting to consider how KZR’s trajectory contrasts with that of Interpublic Group, whose current stock price you can check here: ipg stock price today. Understanding the factors influencing IPG’s performance might offer insights into potential future movements for KZR, given their shared industry landscape.

Investor Sentiment and Market Opinion on KZR

Recent news articles and press releases regarding KZR, along with overall market sentiment, influence investor decisions and stock price. Social media also plays a significant role.

Recent news has been largely [Insert description of recent news and its impact on investor sentiment. E.g., positive, with several articles highlighting strong earnings and positive future outlook]. Overall market sentiment towards KZR is currently [Insert description of overall market sentiment. E.g., bullish, driven by positive financial results and strong growth prospects]. Social media discussions about KZR tend to be [Insert description of social media sentiment.

E.g., largely positive, with many users expressing optimism about the company’s future].

Answers to Common Questions: Kzr Stock Price

What are the major risks associated with investing in KZR?

Investing in KZR, like any stock, carries inherent risks. These include market volatility, changes in industry regulations, and the company’s own operational challenges, such as potential decreases in revenue or profitability.

Where can I find real-time KZR stock price data?

Real-time KZR stock price data is readily available through major financial websites and brokerage platforms. These platforms usually provide live quotes, charts, and historical data.

What is KZR’s current dividend yield (if any)?

The current dividend yield for KZR (if applicable) can be found on financial news websites and investor relations pages of the company’s website. It is important to note that dividends are not guaranteed and can change.